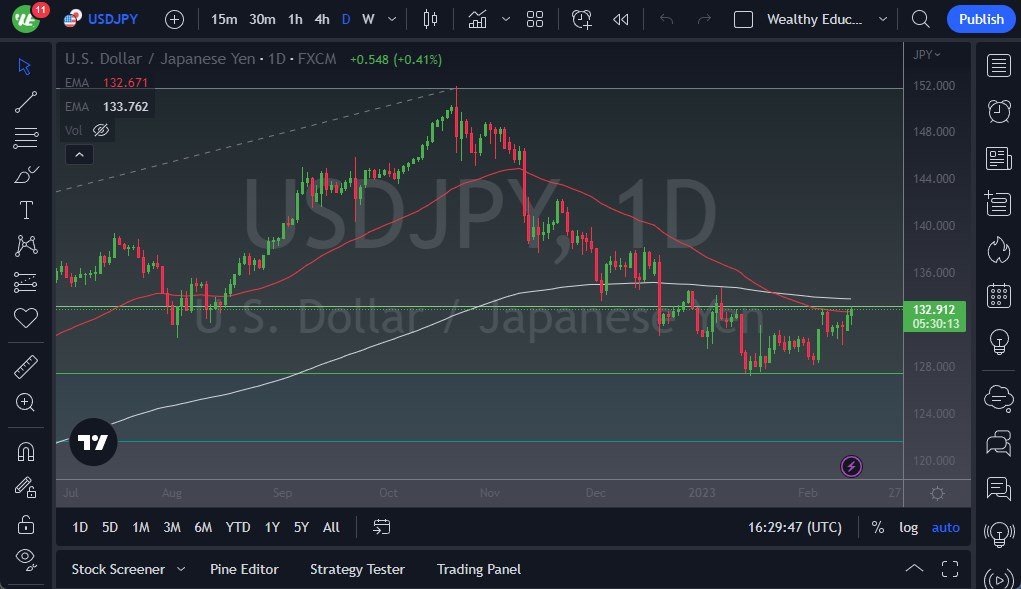

- The US dollar has initially pulled back against the Japanese yen during trading on Tuesday but has turned around to show signs of life again.

- The ¥133 level continues to attract a lot of attention, and of course is an area that is between the 50-Day EMA and the 200-Day EMA indicators.

- Because of this, I would anticipate seeing quite a bit of volatility in this region, as there will be a lot of buyers and sellers in general looking at this.

Market Will Probably Break Out to the Upside

It’s worth noting that the Bank of Japan continues to have to fight against rising interest rates, and then of course has its own influence on the market. After all, the central bank will have to continue to print currency if they have to buy bonds in order to drive down the rate below the maximum 50 basis points that they allow on the 10 year yield. If we were to break above the 200-Day EMA above, then it’s very likely that we could see a flood of buying in this market. That will also be interesting from the standpoint that it would be a scenario where the market continues to see plenty of rate pressure, which of course will continue to kick off a bit of a feedback loop. On the other hand, if we see interest rates around the world drop, that gives a little bit of a reprieve to the Bank of Japan, therefore the Japanese yen.

If we do see interest rates drop a bit, then it’s likely that we could see the US dollar dropped right along with it. That being said, the ¥128 level underneath has formed a little bit of a double bottom, and it is also where the 50-Day moving average is sitting at, from the massive move higher of last year. This has all been about interest rates last year and will be all about interest rates this year. In general, this is a market that I think will continue to see a lot of volatility, but it certainly looks as if we are trying to do everything we can to break out to the upside. If we get a lot of “risk off” type of attitude, that could also drive up demand for the US dollar as well.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.