Advertisement

Today's recommendation on the TRY/USD

The risk is 0.50%.

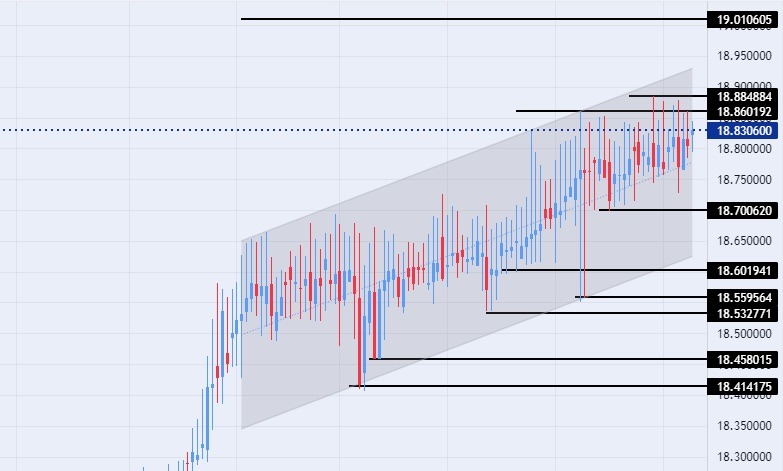

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level AT 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75.

The price of the TRY/USD stabilized amid the almost complete absence of any talk or economic data in the wake of the massive earthquake that struck the country. As the death toll from the strong earthquake that struck Turkey and Syria this week rose to 16,035.

On Thursday, the Turkish Disaster and Emergency Management Authority announced that 12,873 people had been killed in the country. Meanwhile, Twitter has been made available again in Turkey after it was earlier shut down by the government over concerns of "misinformation and false reports".

Turkish President Recep Tayyip Erdogan has criticized allegations that the government has not done enough to respond appropriately to the devastation in the country. "This is a time for unity and solidarity. In a period like this, I can't stand those who launch negative campaigns for the sake of political interest," Erdogan said. He admitted that "our work was not easy" given the disaster and the weather conditions and "of course there are deficiencies," but insisted that all public departments responded quickly and performed their duties when the shaking started.

TRY/USD Technical Analysis

On the technical level, the trading of the USD/TRY stabilized without changes, as the pair recorded slight movements near its all-time high at 18.88, which was recorded at the beginning of this month. The pair continues to trade within the bullish channel levels on today's time frame, as the pair continues its bullish movement, albeit at a slow pace.

The dollar USD/TRY is trading above the support levels of 18.70, 18.60, and 18.53, respectively. At the same time, the pair is trading below the resistance levels at 18.83 and 18.88, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.00. The USD/TRY is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.