Advertisement

Today's recommendation on the TRY/USD

The risk is 0.50%.

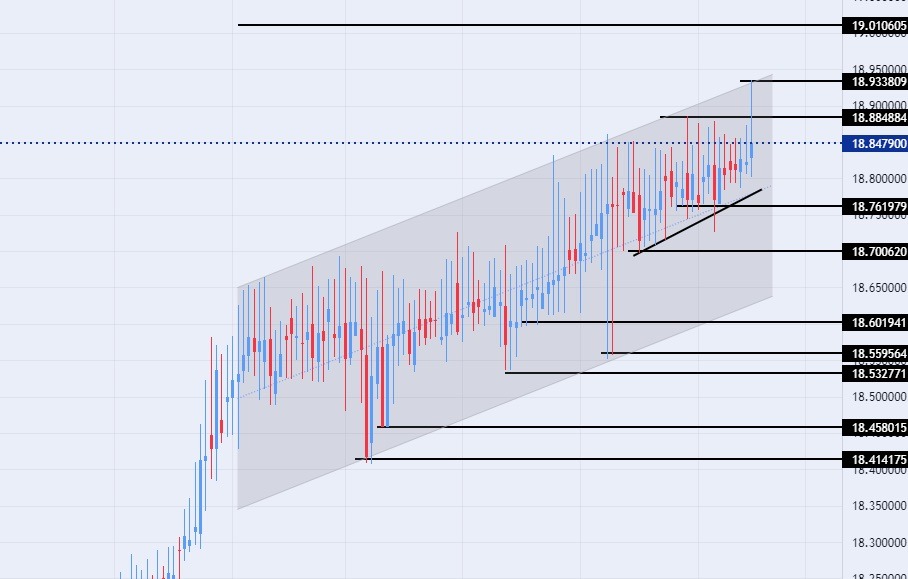

Best buying entry points

- Entering a buy order pending order from the 18.70 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support level at 18.75

The TRY/USD declined during early trading this morning, as the Turkish currency recorded its lowest level against the dollar ever, approaching the barrier of 19 lira per dollar. The repercussions of the natural disaster that shook Turkey and northern Syria still cast a shadow over a lot of data, as the latest estimates revealed losses of approximately $10.4 billion in national income and $2.9 billion due to work being stopped for days. The earthquake that struck southern Turkey had left nearly 40,000 victims.

In this context, the Turkish government issued some decisions aimed at speeding up reconstruction, as it banned the export of container homes and prefabricated buildings for a period of 3 months. Meanwhile, the Istanbul Stock Exchange index went up by 10% after the resumption of trading after five days of the closure decided by the government, following strong declines recorded by the stock market in two sessions following the earthquake, these gains were recorded with the support of some government measures aimed at stopping stock losses. In the meantime, some analysts warned of a decline in confidence in the stock market. Consumer and investor in Turkey.

TRY/USD Technical Analysis

On the technical front, the USD/TRY traded higher. The Turkish currency, which set new records of decline against the dollar, lost after touching 18.94 levels this morning, Wednesday. At the same time, the pair continued to trade within the levels of the ascending channel on today's timeframe, as the pair's bullish movement continued, albeit at a slow pace.

The USD/TRY is trading above the support levels at 18.76, 18.70, and 18.63, respectively. At the same time, the pair is trading below the resistance levels at 18.88 and 18.94, which represents the highest price for the pair ever, and the pair is also trading below the psychological resistance levels at 19.00. The dollar pair against the lira is also trading above the moving averages 50, 100, and 200 on the daily time frame, while the price is trading between these averages on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.

Ready to trade our daily Forex analysis? We’ve made a list of the best Forex brokers worth trading with.