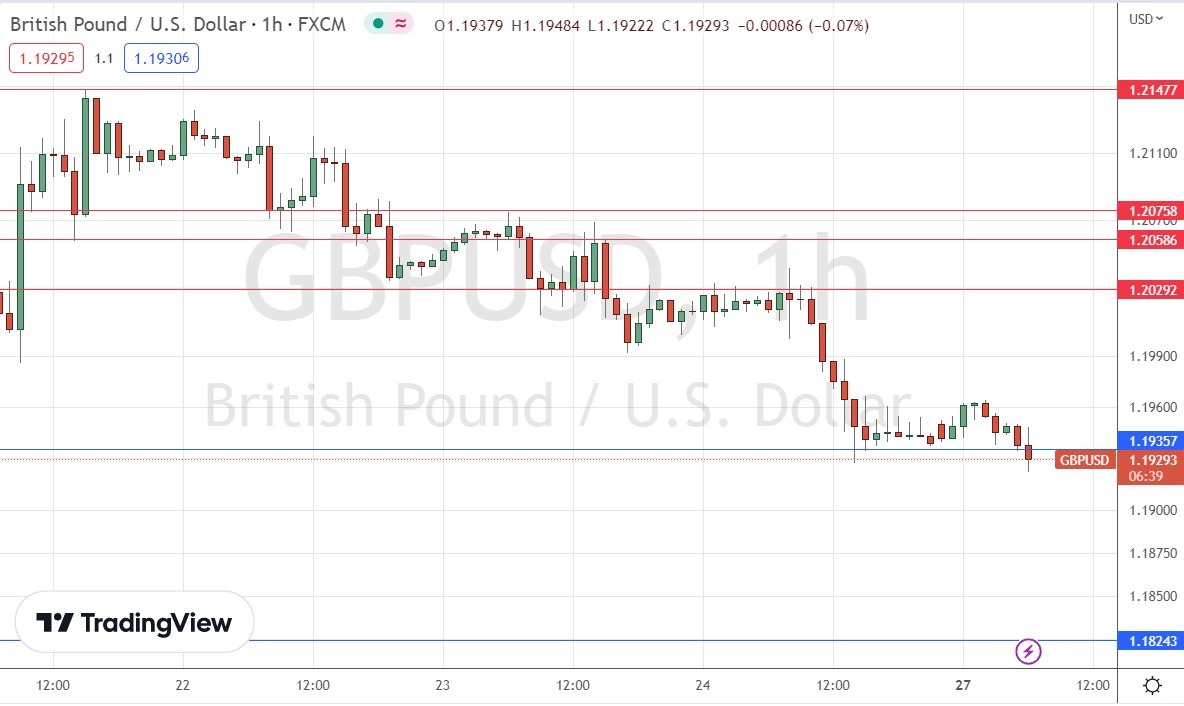

My previous GBP/USD signal on 22nd February produced a slightly profitable long trade from the bullish reversal at the support level which I had identified at $1.2071.

Today’s GBP/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

Long Trade Ideas

- Go long following a bullish price action reversal on the H1 timeframe immediately upon the next touch of $1.1824.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

Short Trade Ideas

- Go short following a bearish price action reversal on the H1 timeframe immediately upon the next touch of $1.1936 or $1.2029.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 25 pips in profit.

- Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to run.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

GBP/USD Analysis

I wrote in my previous forecast for the GBP/USD currency pair that it would be wise to wait for a breakout from this price range between $1.2150 and $1.2058 – I thought that if it broke down, the price would reach $1.2000, although short trades would be more difficult.

This was a good call as once the price got established below $1.2058 it continued to move down over the week, but in a bit of a choppy descent.

The technical picture has become even more bearish as the strong US Dollar and Japanese Yen, as safe-haven currencies, sweep everything before them in the current risk-off market environment, pushed by increasing fears of higher rates and persistently high inflation.

The price is much more about the US Dollar than the British Pound.

Technically, we are seeing a significant bearish development, with the price breaking down below the key support level at $1.1936. If the first two hours of the London session are consecutive lower closes below $1.1936 I will be happy to enter a short trade, as the price has lots of room to fall, possibly all the way to the next support level at $1.1824.

If the price quickly recovers and spends the first part of the London session trading back above $1.1936, that would be a minor bullish sign, but I would not want to take a long trade today in this currency pair under any circumstances.

There is nothing of high importance scheduled today concerning either the GBP or the USD.

Ready to trade our free Forex signals? Here are the best UK Forex brokers worth checking out.