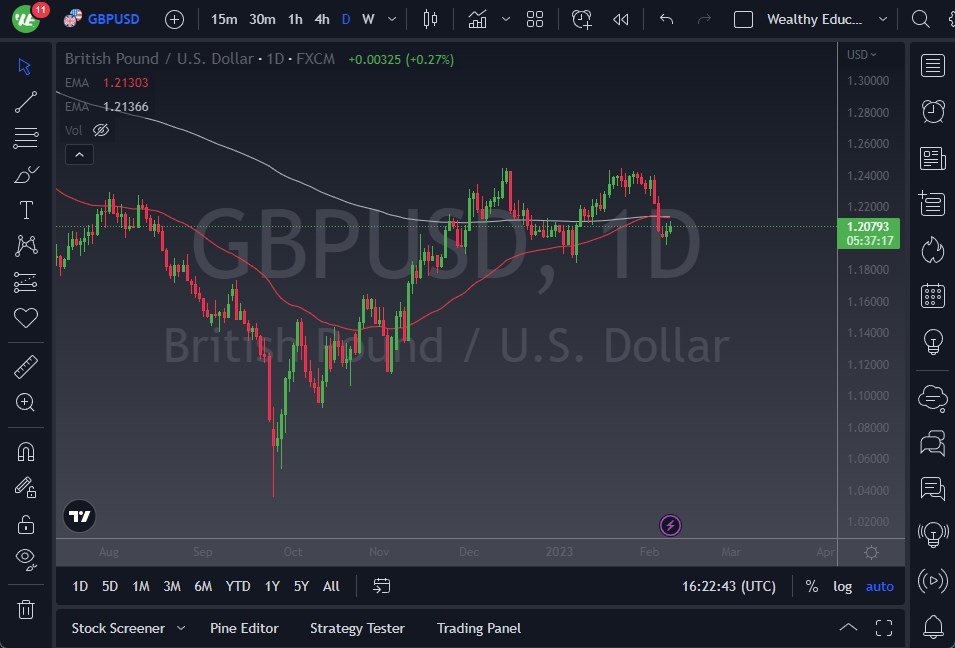

- The British pound has rallied slightly during the trading session on Wednesday, breaking above the top of the indecision candle on Tuesday.

- At this point, it looks like we are facing the 50-Day EMA and the 200-Day EMA indicators above, which could cause us a bit of a headache.

- Breaking above both of those opens up the possibility of a move to the 1.24 level, which is where we had formed a bit of a double top.

GBP/USD Breakout and Breakdown Scenarios

That double top is going to be crucial for the long term, so make sure that you pay close attention to it. If we were to break above there, that would be an obviously bullish sign, and could send this market much higher. Breaking down below the low of the trading session on Tuesday would open up a huge dump lower, perhaps to the 1.1850 level, and anything below there then I think opens up the floodgates back down to the 1.15 region. The British pound obviously has a lot of issues, while the US dollar has been rather strong for a while. With that in mind, I do not have any interest in trying to get too cute with this and am looking for signs of exhaustion that I can short. However, if we don’t get that and we break above the 1.25 level, then you cannot argue with that, you have to accept the fact that the market wants to go higher.

Interest rates of course have a major influence on where things are going next, as per usual. Traders continue to wonder what the Federal Reserve will do, despite the fact that the Federal Reserve has been pretty blunt about its intentions. Because of this, I think you continue to have a lot of very noisy behavior, and therefore volatility. Keep your position size reasonable but expect some type of noise above that will continue to offer US dollar strength. Ultimately, I think there are far too many issues out there to think that we are suddenly going to dump the dollar, although in the short term we have gotten slightly overbought. I do believe that we are on the cost of forming some type of major trend change. With this, markets will be noisy and of course hectic, but I also recognize that risk management will be the way forward.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex Broker UK reviews for you.