- The GBP/USD currency pair fell rather hard during the trading session on Friday after we have seen a major shift in attitude.

- The Non-Farm Payroll number came out at 518,000 for last month, instead of the expected 188,000.

- This has people running as fast as they can toward the US dollar, and thereby the British pound got hammered.

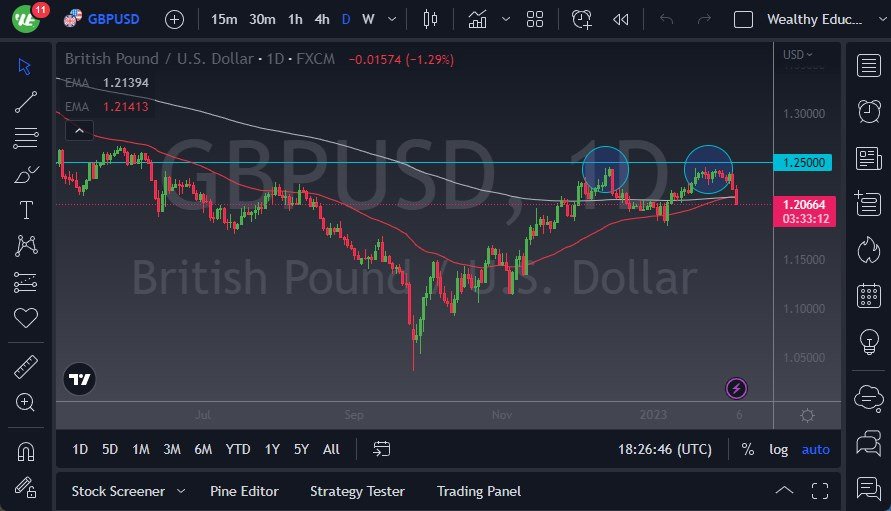

Double Top Confirmed

After all, it does make quite a bit of sense that we would see the British pound get hit due to the fact that the Bank of England is much more dovish than the Federal Reserve. Looking at this chart, it’s obvious that we have just formed a double top, and if we break down below the 1.19 level, that will only confirm it. The market breaking down below there then opens up the possibility of a move down to the 1.15 level. The 1.15 level is a large, round, psychologically significant figure that a lot of people would pay close attention to, and it would obviously attract a lot of attention in general. That being said, I think this is a situation where we continue to see further downward pressure, as we are closing at the very bottom of the candlestick. That typically means that we are going to see more of the same, and a bit of follow-through.

If we do turnaround from here, I will look for some type of exhaustion that we can start selling into, because it’s obvious that we just don’t have enough momentum to turn things around at the moment. How the market behaves after the weekend is a completely different question but given enough time, I do think that eventually we break down. This is something that I’ve been paying close attention to for a while, so I look at rallies that could be shorted at the first signs of exhaustion. I like the idea of buying US dollar still, and it looks like we are trying to do everything we can to change the overall trend that we had been in, and go back to the longer-term trend that sent the Pund so much lower, as well as many other pairs against the greenback. I think at this point, we are going to get a massive correction in the US dollar selling, and this could be rather vicious in general.

Ready to trade our Forex daily forecast? We’ve shortlisted the best regulated forex brokers UK to trade with.