Advertisement

Today's recommendation on the lira against the dollar

The risk is 0.50%.

Best buy entry points

- Entering a buy order pending order from 18.60 levels

- Place a stop loss point to close below the support levels 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 19.00.

Best-selling entry points

- Entering a sell order pending order from 19.00 levels

- The best points to place a stop loss close the highest levels of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support levels 18.75

Analysis of the Turkish lira

The exchange rate of the Turkish lira stabilized against the dollar during early trading this morning, Tuesday. Investors followed several external reports, the most important of which is the World Bank's expectations for the Turkish economy during the year 2023, which showed a decline.

The World Bank report expected the Turkish economy to grow by 2.4%, and forecasts indicated that the GDP could grow by 4% in 2024. This is compared to a growth rate of 4.7% during 2022. While investors await official data on the growth rate during the past year at the end of next month. The World Bank report regarding the growth prospects of the Turkish economy stated: "Growth in Turkey faces some headwinds and some risks, especially with the expansion of inflation and the sharp widening of the current account deficit." The report also cited fears of expanding government expenditures ahead of the mid-year elections, despite slowing exports and slumping domestic demand due to persistent inflation and heightened policy uncertainty.

Technical Outlook

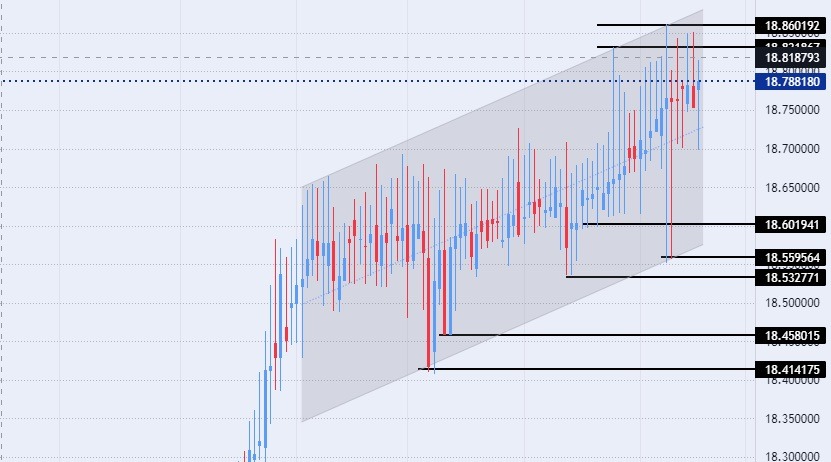

- The dollar pair traded against the Turkish lira, near its all-time high, as the pair traded within the bullish channel levels on today's time frame.

- This will continue the pair's rise, albeit at a slow pace.

Currently, the dollar against the pound is trading above the support levels of 18.70, 18.60, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.86, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at the integer 19.00. At the same time, the dollar pair against the lira is trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.