Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

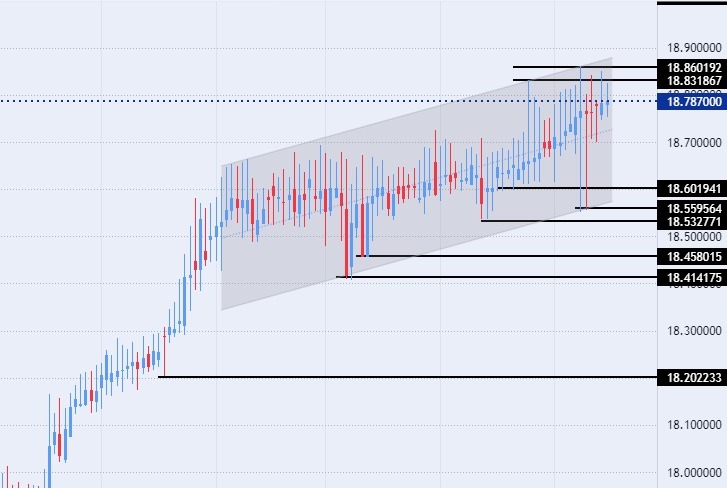

- Entering a buy order pending order from the 18.60 level.

- Place a stop loss point to close below the support level at 18.45.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The exchange rate of the TRY/USD stabilized during early trading on Monday morning. The Central Bank of Turkey continued its efforts to encourage an increase in the volume of deposits in the lira in the banking system, as the bank decided to cancel the previous reserve requirements for deposits in lira with maturities of three months, which amounted to 6%. This percentage is scheduled to remain at 8% for deposits with a short term. Maturity of three months.

According to the statement of the Central Bank of Turkey issued last Saturday evening, these changes are scheduled to be implemented as of February 3. At the same time, investors followed the statements made by Turkish Finance Minister Noureddine Nabatai, issued today, Monday, in which he announced that the country’s budget deficit was about 139.1 billion liras, which was approximately $7.5 billion during 2022, as the deficit rate is less than 1% of the total. The initial budget surplus recorded about 171.8 billion pounds over the past year. The data or decisions of the Central Bank were not reflected in significant impacts on the price of the lira, whose levels are controlled by the Central Bank, as it settled at the same closing levels as last week.

On the technical front, the trading of the USD/TRY has stabilized near its highest levels ever, as the pair recorded limited changes. Currently, the pair traded within the levels of the bullish channel on today's timeframe, as the pair continues to rise, albeit at a slow pace. The dollar against the pound is trading above the moving averages 50, 100, and 200 on the daily time frame as well as on the four-hour time frame, in a sign of the general bullish trend for the pair.

Currently, the dollar pair against the lira is trading above the support levels of 18.60, 18.55, and 18.53, respectively. On the other hand, the pair is trading below the resistance levels at 18.83 and 18.86, which represents the highest price for the pair ever, as well as the pair is trading below the psychological resistance levels at 19.00. Any decline in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.