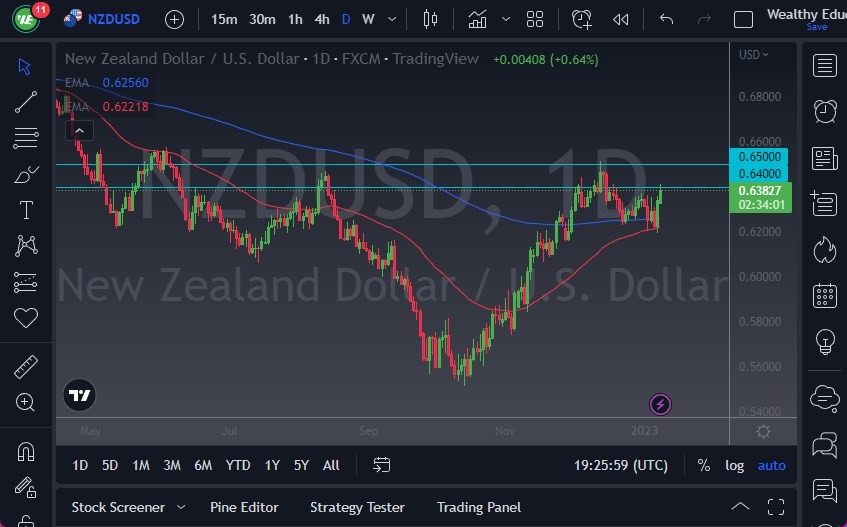

- The NZD/USD has rallied significantly during trading on Monday, reaching the 0.64 level.

- However, I see a lot of noise between 0.64 and 0.65 above there, so the fact that we pulled back is not much of a surprise.

- Do I think that the market is suddenly going to fall apart? Not necessarily, but I do see a couple of potential problems this week that could come into this rally and send the New Zealand dollar lower.

Keep in mind that Jerome Powell is speaking tomorrow, and the world of course will be listening. If he sounds hawkish again, it could send the US dollar higher, and therefore send this pair lower. That being said, if the market were to suddenly take off above the 0.65 level, that could open up a huge move to the upside. You can also make an argument that there is a flag here, so certainly there is a technical reason to believe that we could go higher. However, not only do we have Jerome Powell speaking on Tuesday, but we also have the CPI figures coming out on Thursday, which can also cause a lot of noise in this pair.

I Expect a Noisy Behavior

Looking at this chart, I expect to see a lot of noisy behavior, with the 200-Day EMA near the 0.6250 level, right along with the 50-Day EMA sitting just below there. In other words, I think this is a market that could be very noisy and very volatile. That would not be overly surprising for the New Zealand dollar, because it is also highly sensitive to risk appetite, and should be recognized as being a bit thinner than many of the other currencies out there.

You should also keep in mind that the New Zealand dollar is a commodity currency, so that has a lot to do with where it goes as well. It is highly levered to Asia and Asian demand, which is a bit suspicious at this point. We could very well see a lot of noise in this area, but by the end of the week we might have a bit more in the way of clarity as not only do we have all of that, but then we start to see Wall Street enter its earnings season, which also could be another catalyst for risk either rising or falling.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.