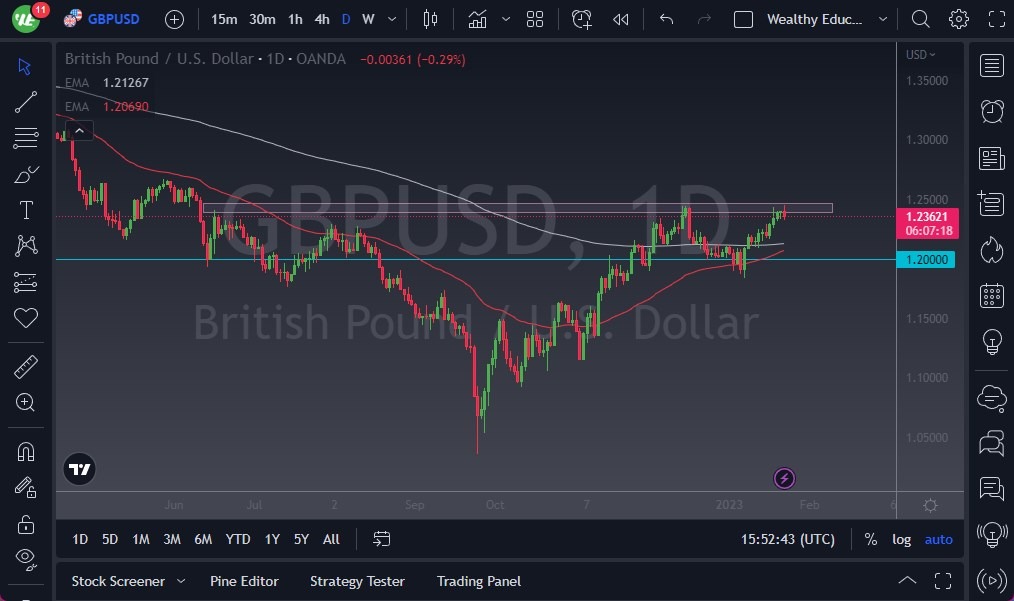

The GBP/USD has gone back and forth during the session on Monday, as we continue to see a lot of noisy behavior. Ultimately, the 1.25 level I think is a major ceiling, and if we can break above there is likely that we could go higher, perhaps reaching the 1.2750 level.

On the other hand, if we break down below the bottom of the candlestick, it could kick off a significant “double top” at this point, perhaps sending the market down to the 200-Day EMA. The 50-EMA is trying to break above the 200-Day EMA, kicking off the “golden cross” that a lot of people pay close attention to. The 1.20 level sits just below there as well, so I think all that adds quite a bit of support to the market. However, a lot of this is going to come down to risk appetite, and therefore we will have to watch how other markets are doing as well because risk appetite tends to be one of those correlations that spread across the world.

We Are About to Get a Big Move

- All things being equal, the British pound also must worry about the fact that even though there’s a lot of inflation in the United Kingdom, the reality is that there is a serious lack of growth.

- In other words, it’s difficult to imagine where the British pound has an easy route in either direction.

- Ultimately, if we were to turn around and break down below the 1.20 level, then it’s likely that we get a significant breakdown as it would confirm the double top and send this market looking toward the 1.15 level.

- Breaking above the highs and the 1.25 level opens 1.2750 as I said, but I think given enough time to probably go to the 1.30 level.

More likely than not, what we have more than anything else is going to be a lot of noisy and choppy behavior, and therefore you need to keep your position size reasonable as it’s difficult to imagine anything along the lines of stability in a market that has been so noisy. At this juncture, I think we are at a very important point of inflection, so, therefore, I will be watching this quite closely as we are about to get a big move one way or the other.

Ready to trade our Forex daily forecast? We’ve shortlisted the top UK forex trading platforms in the industry for you.