- The GBP/USD rallied during the trading session on Thursday after the CPI numbers came out of the United States. Quite frankly, the numbers were exactly what people were expecting, so I think it relieves some of that fear of the Federal Reserve being overly hawkish.

- Having said that, there is still a lot of confusion as to what the Fed is going to end up doing, so you need to be very cautious about getting too aggressive one way or the other.

- Ultimately, I think this is a situation where the question at this point is whether they are going to raise interest rates by 25 basis points in February, or if it’s going to be 50 basis points. That is what everybody is asking, and therefore everybody is paying close attention to all the potentially noisy announcements that are out there.

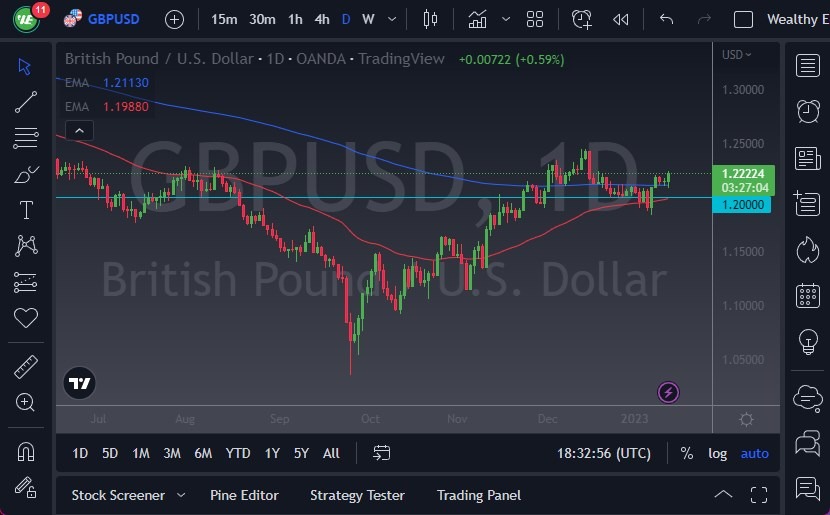

Inflation is still 6.5% year-over-year, which is outrageous. However, there have been a few whispers of the market getting a smaller-than-anticipated interest rate hike, so a lot of this may have already been baked into the price. Regardless, this is a market that certainly has looked bullish as of late so it stands to reason that we would eventually break out.

Avoid Investing a Lot in this Market

At this point, you must ask the question as to whether we are going to continue going higher or not, but right now I would say the odds are probably in favor of the bulls. If we can break above the 1.2450 level, it’s possible that this market could go looking all the way to the 1.25 level, and then the 1.30 level.

However, if we break down the 200-Day EMA underneath, it’s possible that we could look to the 1.20 level underneath as a potential target. Regardless, this is a market that will more likely than not continue to see a lot of noisy behavior, as there are a lot of concerns out there when it comes to the British economy. Overall, I think this is slightly bullish, but I’m not expecting some type of massive breakout anytime soon. With that being said, we don’t necessarily have a short signal yet either, so I’m neutral with a slightly upward bias in the moment. I would not put a lot of money into this market right now.

Ready to trade our Forex daily forecast? We’ve shortlisted the top UK forex trading platforms in the industry for you.