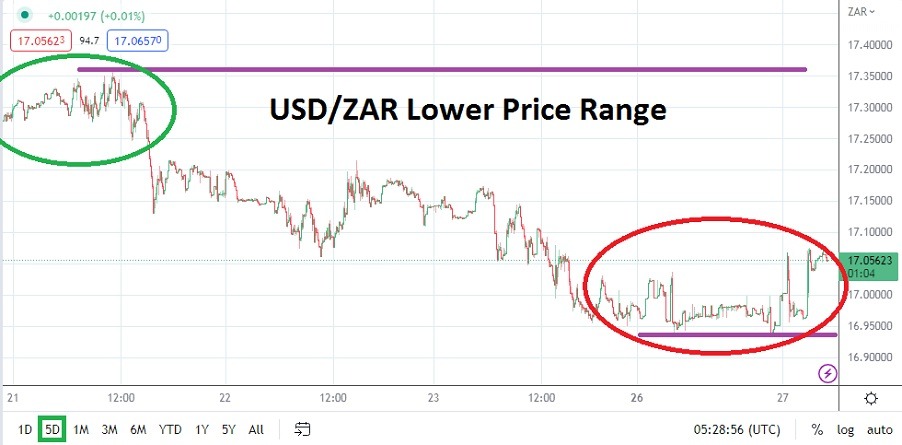

The USD/ZAR has fallen in price the past week of trading, and this has created a lower price range for speculators to consider, one that could be dangerous in the near term.

The USD/ZAR is near the 17.05700 vicinities as of this writing. Traders participating in today’s Forex session should recognize that holiday volumes will continue to be thin, not only today but throughout the week. This will make wagering on the USD/ZAR rather challenging and speculators are urged not to be overly ambitious.

Last Week’s Results may NOT be a Full Confirmation of the USD/ZAR Trend

While the USD/ZAR continued to enjoy a bearish trend which may have produced good betting results last week, traders should not get overconfident. On Monday of last week the USD/ZAR certainly was trading near highs around the 17.69000 ratios and then sank like a stone to the 17.20650 vicinities. After that, the USD/ZAR turned in a slight reversal higher to the 17.44300 areas and then began to incrementally fight lower.

The two days of trading to end the week before the Christmas holiday saw selling continue and a low of 16.95550 was flirted with on Friday. However, this occurred as thin trading volumes were being demonstrated and financial houses had started to disappear. The result of the downside price momentum may have been predicted, but it doesn’t mean it is guaranteed to continue near-term.

USD/ZAR Support Ratios During this Holiday Week Should be monitored

The USD/ZAR is trading within sight of important support. The last time the USD/ZAR traded below the 16.95000 mark was a brief couple of days in the last week of November. Day traders need to consider how strong momentum can be while most of the larger institutional financial houses are not participating in the marketplace.

- Yes, there will be trading of the USD/ZAR, but until the New Year’s holiday is complete, results may be choppy and dangerous.

- The 17.00000 may work as a target for traders as a take-profit location for selling wagers via bearish perceptions, but patience may be needed. Traders need to make sure their price targets are cautious if they intend on making only a day trade.

The USD/ZAR may look like it intends on trading lower, but the holiday season combined with the fact that the currency pair sold off strongly last week may attract contrarians. The lack of full trading volume in the USD/ZAR this week certainly could open the door for the opportunity to see buyers gain a foothold and for the Forex pair to actually present a reversal upwards which the 17.10000 ratio appears tempting. Risk management and short-term betting notions are advised for the USD/ZAR.

USD/ZAR Short-Term Outlook:

Current Resistance: 17.09600

Current Support: 17.00100

High Target: 17.18400

Low Target: 16.90000

Ready to trade our Forex daily analysis and predictions? Here are forex trading brokers in south africa to choose from.

Ready to trade our Forex daily analysis and predictions? Here are forex trading brokers in south africa to choose from.