Today's recommendation on the TRY/USD

The risk is 0.50%.

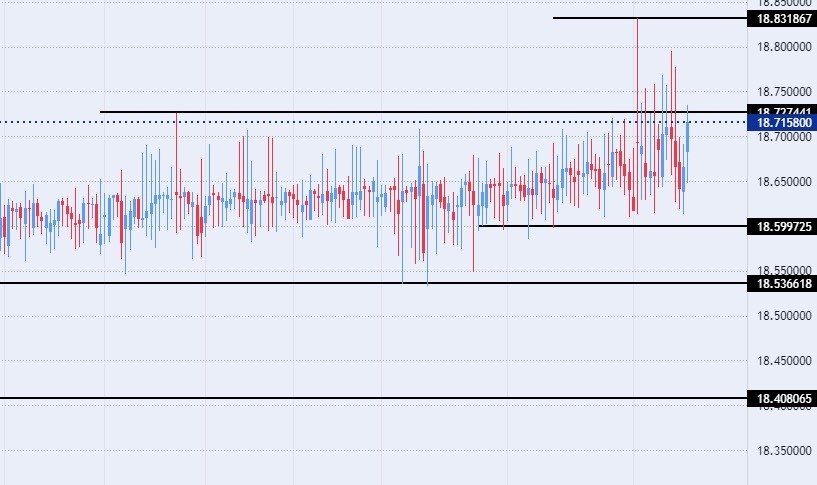

Best buying entry points

- Entering a buy order pending order from the 18.60 level

- Place a stop loss point to close below the 18.35 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 19.00.

Best-selling entry points

- Entering a sell order pending order from the 19.00 level.

- The best points to place a stop loss close the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.75 support level.

The price of the USD/TRY stabilized, after the pair recorded its highest levels ever, during yesterday's trading. Despite the stability of the lira's movement over the past two months, it notes the general bullish trend through which the pair is moving in the long run. The intervention of the Turkish Central Bank and the Ministry of Finance in the country had prevented the Turkish lira from recording large losses, despite the stimulus policy pursued by the Turkish Central Bank under pressure from Turkish President Recep Tayyip Erdogan.

Erdogan was insisting on paying the interest rate to the single digits, which he did. Indeed, with the interest rate cut from 14% to 9% over four consecutive meetings of the Central Bank of Turkey, before the interest rate was fixed during this month's meeting. It is noteworthy that the lira's decline took place despite the start of the economic figures turning in a more positive way for the Turkish economy, as inflation began to decline after it recorded 85%, which is at its level in about 24 years.

USD/TRY Technical Analysis

On the technical front, the USD/TRY was stable manner, after it recorded new highs during this week's trading, as the dollar rose to record 18.83 lira. Before retreating to the same limited trading range in which the pair has settled for a period of more than two months since mid-October. Currently, the TRY/USD is trading above the support levels of 18.53 and 18.40, respectively.

On the other hand, the pair is trading below the resistance level at 18.83, which represents the highest price for the pair recorded in 2022. The pair is also trading below the psychological resistance levels at 19.00. The USD/TRY trades above the moving averages 50, 100, and 200 on the daily time frame, in a sign of the general bullish trend of the pair, while the price trades between these averages on the four-hour time frame, as well as the lower time frames, in a sign of the divergence recorded by the pair in the medium term.

Ready to trade our free Forex signals? Here are the best Forex brokers to choose from.