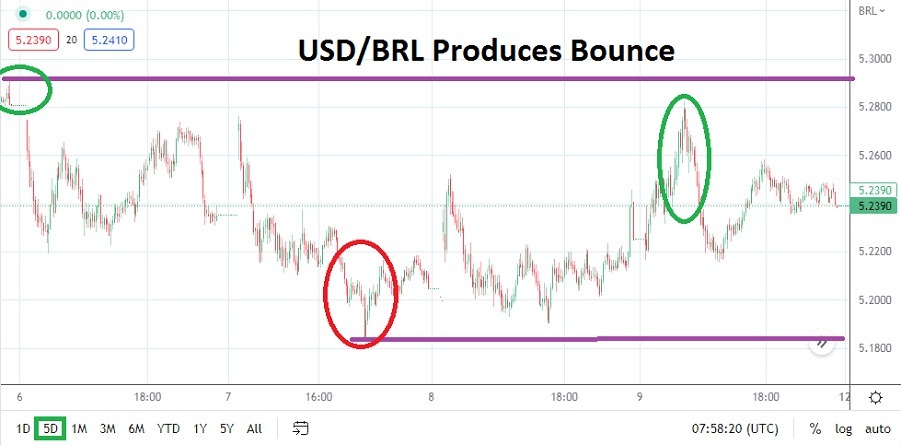

The USD/BRL went into the weekend near the 5.2390 mark, which essentially put the currency pair’s value within the middle of its range considering a five-day trading chart. Having opened last week’s trading with a gap higher which was a reaction to the selloff on Friday the 2nd of December, the USD/BRL then turned in a rather calm Forex performance as equilibrium was sought and a tight choppy range emerged.

However, the trading of the USD/BRL still reflects an open question regarding its outlook. Day traders should not worry about long term perspectives unless they believe those thoughts are going to affect what is happening short-term. The price action of the USD/BRL this coming week may give answers to these open questions regarding behavioral sentiment.

U.S Fed Expected to Raise Interest Rates by 0.50% on Wednesday

Traders who consider fundamentals likely know the U.S Federal Reserve will announce the results of its FOMC meeting this Wednesday. While the U.S. central bank is expected to raise its interest rate again, the potential hike has been factored into the price of the USD/BRL already by most financial institutions. Only a massive surprise from the Fed would create bedlam in the USD/BRL this week.

The USD/BRL is not likely to rise on a 0.50% interest rate hike from the U.S. Federal Reserve. The USD/BRL could however rise if financial institutions are nervous about Brazil’s fiscal policy, which would potentially make the Brazilian Real weaker long-term.

The range between 5.2000 and 5.3000 for the USD/BRL should be monitored

- If the USD/BRL can maintain a rather polite range between the 5.2000 and 5.3000 ratios in the short term, this may allure speculative positions.

- Speculators who believe the USD/BRL has been too bearish may want to consider buying positions of the currency pair on slight selloffs which test current support levels.

The gap which will certainly come upon the opening of the USD/BRL will be intriguing. Last week’s ability to jump swiftly higher, only to reverse lower and then perform a rather consolidated range the remainder of the week should be considered. If the USD/BRL opens higher it may run into resistance around the 5.2600 to 5.2700 levels. If this is broken higher and the USD/BRL tests last week’s highs near 5.2800 today or tomorrow, this could be a bullish signal.

It is likely the USD/BRL will continue to deliver a rather choppy range which continues to react to technical short-term range bias. If the 5.2250 to 5.2100 ratios are tested lower, this might be an opportunity to buy the USD/BRL and look for upside momentum. Support levels in the short-term may prove more durable than resistance levels up above.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.2490

Current Support: 5.2270

High Target: 5.2730

Low Target: 5.2020

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.

Ready to trade our Forex daily forecast? We’ve shortlisted the best Forex brokers in the industry for you.