Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.50 level.

- Place a stop loss point to close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 18.99.

Best-selling entry points

- Entering a sell order pending order from the 18.99 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support level.

The price of the TRY/USD stabilized during early trading today, Tuesday, without major changes. Investors followed data issued by the Turkish Statistical Institute yesterday, which showed a decline in the consumer price index in the country during the month of November, as the index fell by 2.88% compared to the number last October. The index fell for the first time since May of last year. The annual inflation rate was 84.39% during the month of November. The increase in the consumer price index came on an annual basis due to the increase in transportation prices (increase in energy imports) by 107.03%, followed by the increase in the prices of food and non-alcoholic beverages, which recorded an increase of 102.55%. Turkish Minister of Treasury and Finance Noureddine Nabati commented on the data, saying, “We will start to feel the declining trend of inflation more clearly starting next month, with the impact of the monetary policy pursued by the Turkish Central Bank, which is cutting interest rates, while it is looking for alternative tools to raise interest to curb it.

It is noteworthy that inflation in the country reached the highest level in 25 years, following Erdogan's new policy. This encourages lowering interest rates to encourage investment.

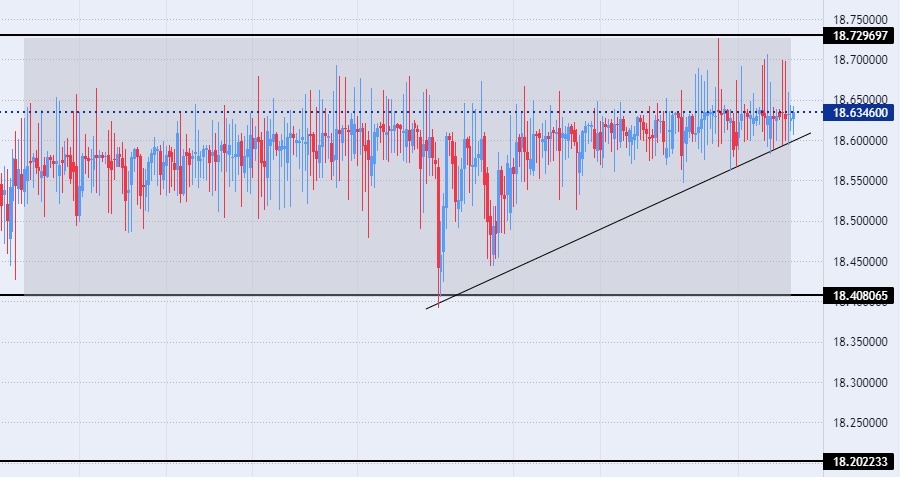

TRY/USD Technical Analysis

On the technical front, the Turkish lira pair stabilized against the dollar, with no change during today's trading. The pair recorded a new peak at 18.72 levels during last week's trading, before returning to the narrow trading range in which the pair has been trading for nearly two months. The declining trend of the Turkish lira against the dollar can be seen in the lower time frame as the pair is trading above a small trend line within the limited range of the price. The US dollar pair traded against the Turkish lira above the moving averages 50, 100, and 200 on the daily time frame, indicating the general bullish trend of the dollar against the lira, while the price traded between these averages on the four-hour time frame as well as on the 50-minute time frame, in a sign of the divergence that the pair records it in the medium term.

At the same time, the pair is trading above the support levels that are concentrated at 18.40 and 18.20, respectively. On the other hand, the pair is trading below the resistance level at 18.72, which is the highest recorded peak for the pair, as well as the psychological resistance at 19.00. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers to check out.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex brokers to check out.