Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from the 18.50 level.

- Place a stop loss point to close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 18.99.

Best-selling entry points

- Entering a sell order pending order from 18.99 level.

- The best points to place a stop loss close to the highest level of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The TRY/USD traded without major changes in the absence of influential economic data in light of the approaching year-end holidays and the decline in trading momentum. Investors followed some of the decisions issued by the Turkish government aimed at strengthening stability, such as extending the mechanism of the Turkish lira deposit system, which is protected from exchange rate fluctuations, for another year. Meanwhile, Turkish President Recep Tayyip Erdogan issued a decision to reduce the car tax hike rate to 61.5 percent, as part of the current government's efforts to combat inflation, which has declined slightly after it recorded its highest level in about 24 years, recording 85 percent.

The remaining days of this year may witness some stability in light of the Turkish Central Bank maintaining the price of the lira at the current borders since last October. The Turkish lira lost about 29% of its value in 2022 compared to a loss of 44% of its value during the past year. The Turkish President, Erdogan, and his ruling Justice and Development Party are looking forward to the decisive elections that are expected to take place in the middle of next year. The Turkish president faces economic challenges in conjunction with the rise in the vocal mass of young people who only lived through the period of Erdogan's party's rule.

TRY/USD Technical Analysis

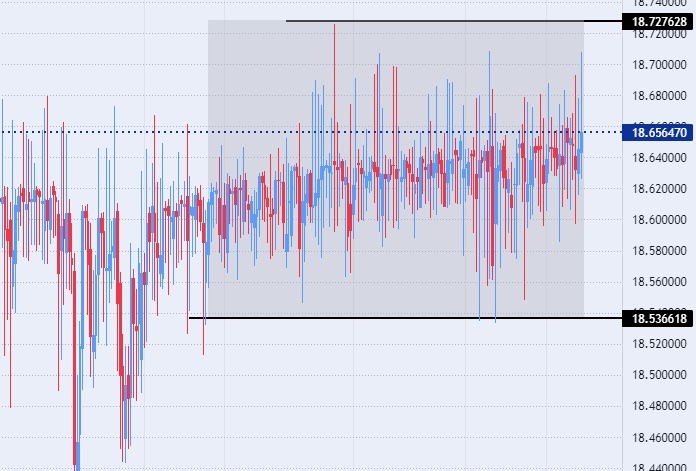

On the technical front, the dollar pair against the Turkish lira maintained its stability during early trading this morning, Wednesday, at the same levels it has traded at since the beginning of this month. Where the pair maintained its trading within a limited range that the pair did not cross for more than two months, specifically since mid-October.

The USD/TRY is trading above the support level of 18.53 and 18.40, respectively. On the other hand, the pair is trading below the resistance level at 18.72, which represents the highest price for the pair recorded during the current year. The pair is also trading below the psychological resistance level at 19.00. The pair trades above the 50, 100, and 200 moving averages on the daily time frame, a sign of the general bullish trend of the pair.

The price trades between these averages on the four-hour time frame, as well as the lower time frames, in a sign of the divergence recorded by the pair in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free daily Forex trading signals? We’ve shortlisted the best Forex brokers in the industry for you.