Today's recommendation on the TRY/USD

The risk is 0.50%.

Best buying entry points

- Entering a buy order pending order from 18.50 level.

- Place a stop loss point to close below the 18.25 support level.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance level at 18.99.

Best-selling entry points

- Entering a sell order pending order from 18.99 level.

- The best points to place a stop loss close the highest levels of 19.15.

- Move the stop loss to the entry area and follow the profit when the price moves by 50 pips.

- Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the 18.55 support levels.

The TRY/USD maintained its stability with the opening of weekly trading. During the holiday, investors followed the Turkish government’s decision to extend the work of the protected deposit system from exchange rate fluctuations, a system that was launched by the Turkish President, Recep Tayyip Erdogan, about a year ago, when the lira recorded its weakest level ever. It is a system that aims to preserve savings in the local currency from fluctuations in the price of the lira against the dollar. It allows the depositor to obtain the declared interest, in addition to the difference in the dollar price between the deposit and withdrawal times.

Some analysts believe that this mechanism represents a convincing interest rate hike, with the Turkish president's insistence on reducing interest rates in the country, which he sees as the mother of evils. He called on the country's central bank (which he actually controls) to continue reducing interest rates, which has been achieved over the past four meetings of the bank, where the interest rate was reduced from 14% to 9%.

It is noteworthy that the Turkish government is following all measures that may stabilize the Turkish economy during the period leading up to the crucial elections expected during the middle of next year. The Turkish economy has faced several difficulties over the course of the current year, with inflation rising to its highest level in 25 years, recording 85%, and the lira losing about 29% of its value during the current year.

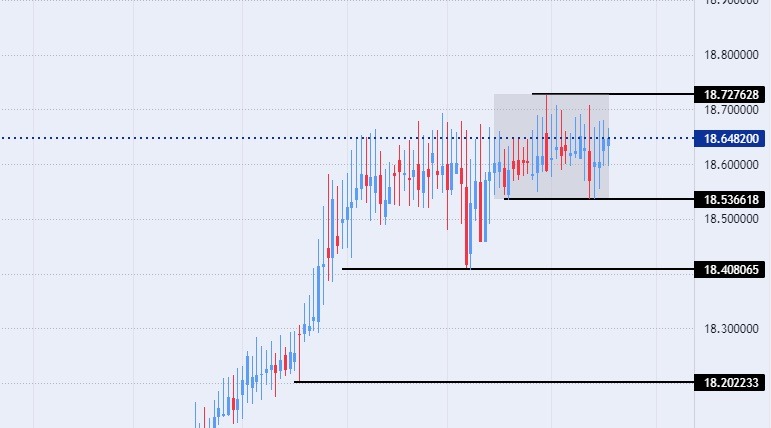

TRY/USD Technical Analysis

On the technical front, without any change, the dollar stabilized against the Turkish lira, with the opening of the weekly trading. The pair maintained its trading within a limited range, which has settled in its range since the middle of last October. Currently, the USD/TRY is trading above support levels, which are concentrated at 18.53 and 18.40, respectively.

On the other hand, the pair is trading below the resistance levels that are concentrated at 18.72, which is the highest price for the pair recorded during the current year. It is also trading below the psychological resistance levels at the integer 19.00. In the meantime, the dollar pair traded against the lira above the moving averages 50, 100, and 200 on the daily time frame, indicating the general bullish trend of the pair, while the price traded between these averages on the four-hour time frame, as well as the lower time frames, in a sign of the divergence recorded by the pair in the medium term. Any drop in the pair represents an opportunity to buy back again. Please adhere to the numbers in the recommendation, while maintaining capital management.

Ready to trade our free trading signals? We’ve made a list of the best Forex brokers worth trading with.