- Gold markets have rallied again during the session on Tuesday, to break back above the $1800 level.

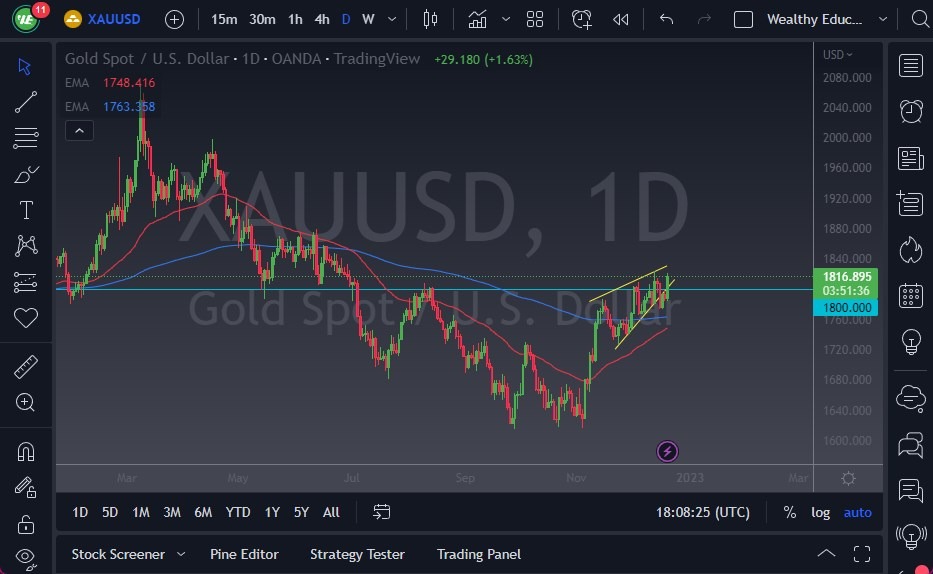

- When you leave this chart, you can see that we had previously been in an uprising channel, forming an ascending wedge.

- We have broken through it but then turned around during frantic trading on Tuesday. In fact, we tested the highs from last week, and now it looks as if we must decide whether or not we are going to continue to climb.

If we do break higher, then this market could go looking to the $1875 level, perhaps even the $1900 level. That obviously would probably need a little bit of hope from the currency markets, as a got during the Tuesday session after the Bank of Japan shocked the world by allowing bonds to float higher as far as interest rates are concerned. This caused pressure on the US dollar, but the markets have turned around quite a bit since then. In other words, it’s likely that we could see the gold market react as such. On the other hand, if we turn around a fall from here, we may just jump back and forth in this area.

We Are at a Major Inflection Point

The 200-Day EMA sits underneath the recent consolidation, so I do think that it’s a situation where we could target that area if we do fall, perhaps offering a bit of support there. Furthermore, the 50-Day EMA seems to be racing toward there, so it could cause a bit of a “golden cross” in the market. That attracts a lot of attention, but ultimately, I think it’s only worth so much. If we break down below both of those moving averages, then it opens a flush lower in the gold market.

I think one thing that you need to be aware of is that it is the holiday season, so liquidity becomes a major issue. This is especially true in the gold market, as it is geared toward the United States, at least in the futures market. The spot chart, which is what you have in front of you, follows the futures market so that is also something that you need to be aware of as well. At this point, we are at a major inflection point so we may get a big move, but it might also have to wait until January.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.