The exchange rate of the pound against the dollar restored some of its previous gains in the last session of trading last week. This is after official data indicated that employment growth in the United States continued in November at a faster pace than many had expected, with possible repercussions on the Federal Reserve interest rate policy. The gains of the upward rebound of the GBP/USD pair brought it to the resistance level of 1.2310, the highest for the currency pair in five months, and it closed the week's trading stable around the level of 1.2290.

US economic figures

About 263,000 Americans found their way to work during November, while the number of new US jobs created in October was revised higher from 261,000 to 284,000, surprising an economic consensus that was looking for a smaller increase of 200,000 in November, and 197K again in October. This result is likely to have important implications for the outlook for US interest rates, given that US Federal Reserve Chairman Jerome Powell said last week that “a moderation in labor demand growth is needed” if the Fed is confident that inflation will eventually return to 2.0%. %. targeting.

Commenting on this, Hussein Mahdi, an analyst at HSBC Asset Management, says: “Employment in the United States along with other measures of labor market activity such as job vacancies and wage growth is still too high for the Fed’s desire.” “With this in mind and amid broader US economic resilience and steady core inflation, we believe speculation that the Fed will pause tightening once the January/February meeting is unjustified,” Mahdi added, following a review of the data.

Powell added earlier this week that strong and sustained demand for workers has been combined with shrinking labor supply to push wage growth rates to levels that could push the federal inflation target of 2% out of reach for an extended period of time. The shrinking labor supply has been attributed to the coronavirus, reduced immigration during the pandemic, and the abnormally high number of individuals who have chosen to retire in recent years, the latter attributed to the wealth generated by the stock market uprisings that occurred during the pandemic. For her part, says Catherine Judge, an economist at CIBC Capital Markets: “The Fed is looking for a calm in the labor market in order to return inflation to the target, and the employment data for November did not offer much on this front.” There were a few pockets of weakness in the report, as the household survey showed a decline in employment for the second month in a row, but when combined with the decline in the participation rate, the unemployment rate was unchanged at 3.7%.

Overall, the supply-demand mismatch appeared to re-emerge on Friday when the US Bureau of Labor Statistics said wages rose 0.6% in November, up from the upwardly revised 0.5% and higher than the 0.3% consensus of economists. Annual wage growth was 5.1% in November, up from 4.9% previously, and a level slightly higher than the core personal consumption expenditures (Core PCE) price index inflation rate reported for October last Thursday.

This particular measure of inflation is the Fed's preferred measure of price pressures in the US, while changes in the wages and salaries paid to workers, particularly those in service industries outside the housing market, can have a significant impact on this particular measure of growth. Prior to that, the minutes of the US Federal Reserve's policy meeting in November indicated that most FOMC members were content last month to stand behind the FOMC's forecast for September, which indicated that US interest rates could rise to 4.75% in the coming months, up from 4% in November. Declining US inflation in October seems to prove this bias, but Powell was already seeing last month that US data argued in favor of higher rates and that Friday's US jobs numbers favored the Fed chairman rather than November's majority in the FOMC.

Forecast for the British pound against the US dollar today:

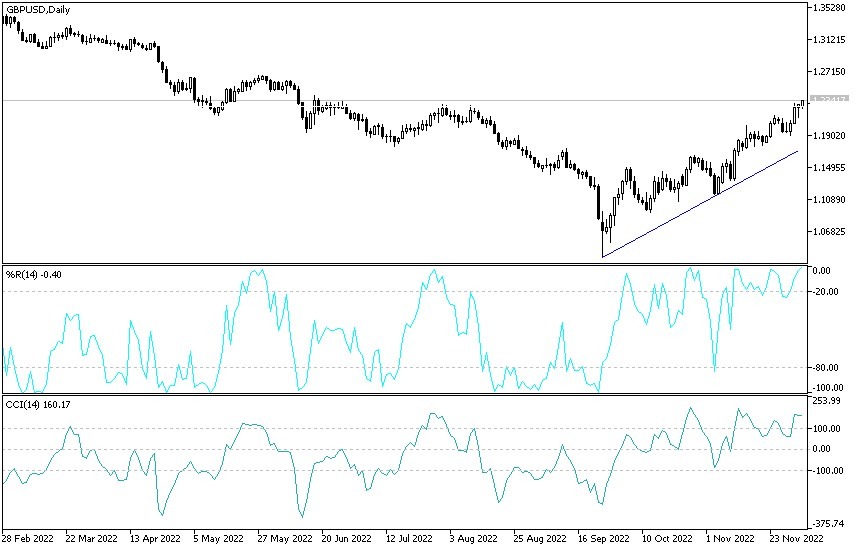

- The path of the upward trend of the GBP/USD currency pair is gaining momentum with the continued decline of the dollar and temporary confidence in the plans to revive the British economy.

- Looking at the performance of the technical indicators according to the daily chart below, they are moving towards overbought levels.

- Unless the pound gets additional momentum, the currency pair may be exposed to profit-taking sales at any time.

- The closest resistance levels for the currency pair are 1.2365 and 1.2420, respectively.

On the other hand, and over the same period of time, the bears need to break the support level 1.2030 to end the current bullish expectations. Readings from the services sector in both Britain and the United States will have a reaction on the performance of the currency pair.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.