The Sterling is facing noticeable selling pressure in the middle of this week's trading, although there is a dearth of news to solidify the moves. UK public sector borrowing data came in worse than expected, but the charts revealed virtually no impact on the pound sterling after their release. Accordingly, the British currency fell by three-quarters of a percent against the dollar and two-thirds of a percent against the euro by midday on December 21st. The losses of the sterling currency pair against the US dollar, GBP/USD, reached the support level of 1.2070, the lowest in three weeks, and it is the closest to breaching the psychological support 1.2000, which supports bear control.

Losses were recorded against all of the other major currencies indicating a clear sterling-centric flavor to the proceedings, although there was no clear data or news stream in the UK to explain the movements. The strange thing is that the losses are coming even though the global equity markets are looking cheerful, indicating that investor sentiment is relatively supported. Sterling remains particularly reactive to global investor sentiment, so the broader context, if any, is supportive.

Looking at the bond markets shows that yields are moving higher, but that is also true of yields in all the other major economies. Indeed, the news for Britain has been decidedly good with gas prices (for January delivery) dropping to their lowest levels since June, meaning the summer's surprise rally has been washed away. On current short-term trends, gas prices could drop to levels they were before the Russian invasion of Ukraine, which is a definite positive for UK consumers and government finances.

Meanwhile, a measure of business confidence in Britain reached a five-month high in December. For its part, Lloyds Bank said in its latest business gauge results, "The recovery was driven by a sharp rebound in optimism about the whole economy." Is bottoming out in UK business sentiment? That may be the case, as the net balance of economic optimism posted its biggest one-month rise since April 2021.

As there are no clear drivers, the GBP's volatility may continue and there is a possibility of a rebound in the coming days. However, if it is pressed to make directional moves, it may appear that the downtrend is easier to achieve at the moment than the uptrend. For his part, Francesco Pessol, Forex Analyst at ING Bank, says, “We still see mostly downside risks for the pound in the new year, as a recessionary environment and sensitivity to market instability may lead to a return to the 1.15-1.18 range in the pound sterling rate. For this Festive season, GBP/USD may settle near 1.2100 -1.2250.”

However, this offers opportunities with near-term payment requirements, however, reaction to moves will be important as clear trends are unlikely to emerge until January.

Sterling forecast against the dollar today:

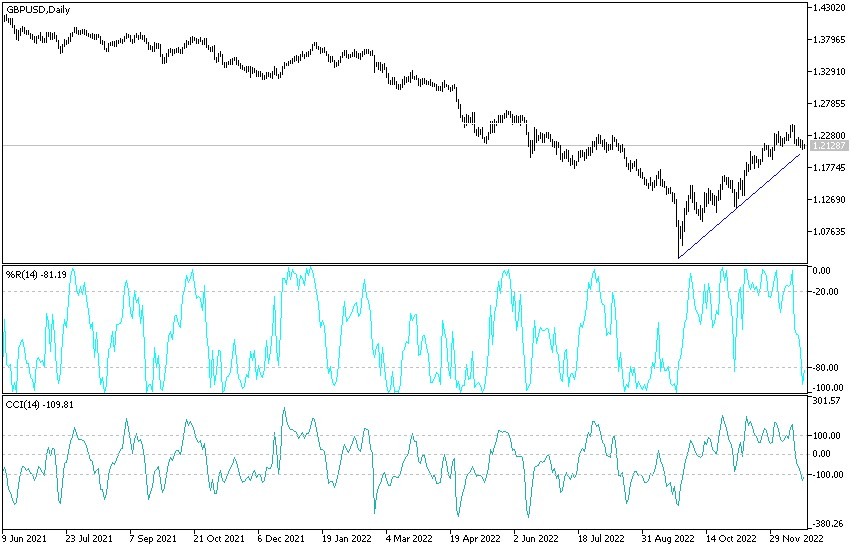

- Returning to the technical analyzes of the GBP/USD currency pair, we have often pointed out that the bearish pressure will be the strongest on the performance of the currency pair.

- The move towards the psychological support level 1.2000 will not be far away.

- The strongest is 1.1945 and 1.1880 which confirms that the technical indicators have reached oversold levels.

- On the other hand, according to the performance on the daily chart, the bulls will not have control again without breaking the resistance 1.2340.

- I still prefer to sell the Sterling / Dollar from every rising level.

Today, the currency pair will be affected by the announcement of the growth rate of both the British economy and the US economy.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.