The US inflation numbers will put pressure on the US Federal Reserve to calm down the pace of raising interest rates in the future.

- The GBP/USD price helped in an upward rebound, with gains that reached the 1.2443 resistance level, its highest in six months.

- This is before settling around 1.2350 at the time of writing.

- The analysis is awaiting the announcement of the British inflation figures and the update of the monetary policy decisions of the US Federal Reserve Bank.

Yesterday it was announced that the unemployment rate in the United Kingdom rose to 3.7% in October from 3.6% in September. Higher wage increases will keep pressure on the Bank of England to raise interest rates tomorrow, Thursday, however, signs that the market is developing some recession will mean the end of the cycle now on the horizon. Despite a slight rise in the unemployment rate, numbers of workers rose by 27,000 in the three months through October, the Office for National Statistics said, defying expectations of a contraction.

Thus, the simultaneous increase in jobs and the unemployment rate indicate that more people are returning to workplaces as the inactivity rate decreased by 0.2 percentage points over the past three months to 21.5%. Data from the National Statistical Office since the Covid pandemic shows that the numbers of the economically inactive in the 50-64 age group has risen significantly. However, the drop in inactivity seen in recent weeks indicates that some of these people are returning to the labor market.

An increase in the labor supply could mitigate upward pressure on wages in the future. But wages are on the rise at the moment. Accordingly, the Bank of England will raise interest rates by a large margin again tomorrow, Thursday, after wages grew at the fastest rate outside the Covid pandemic, ensuring that domestic inflationary pressures will continue to rise. Average earnings with bonuses rose 6.1% in October, accelerating beyond 6.0% in September but coming in below market expectations of 6.2%. However, there are also clear signs that the market is shifting in response to a deteriorating economic outlook as November saw one of the largest monthly increases in jobless claims outside of a crisis/recession ever known.

In general, further signs of the deterioration of the British labor market appeared in the form of a decrease of 65 thousand in the number of vacancies, which led to a fifth consecutive monthly decline. For its part, the Bank of England will begin deliberations on how far to raise interest rates and Thursday's decision is likely to see another 50 basis point hike. Arguments can be made for a repeat of the 75bp rise as wage adjustments continue to rise, but the MPC will likely point to decreasing job vacancies, increasing participation and rising unemployment claims as signs that the labor market is beginning to develop some recession.

Sterling forecast against the dollar today:

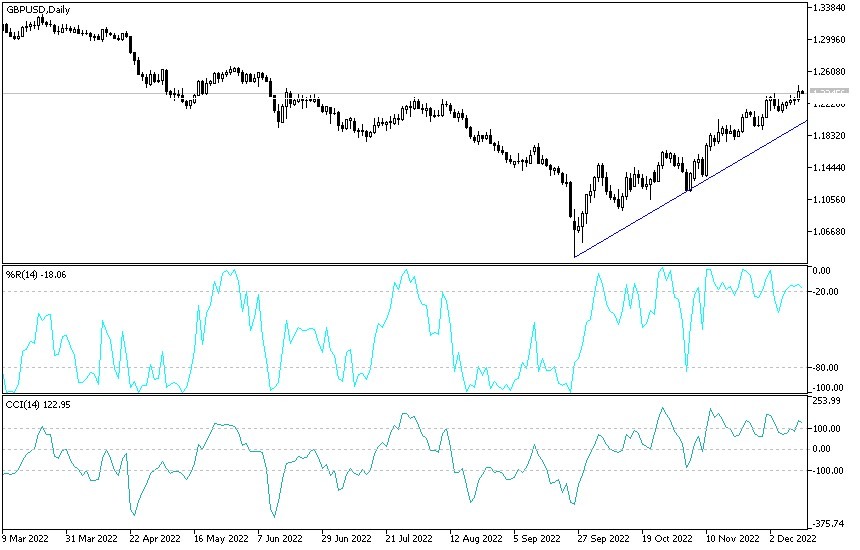

According to the performance on the daily chart below, the price of the GBP/USD pair is in an upward trend and will not abandon the path without moving towards the psychological support level of 1.2000.

The bulls will have the opportunity to breach the resistance 1.2475 again, in case the US Federal Reserve’s tone came today to calm the path of tightening. It is also breaking that resistance is a strong contributor to the movement of the technical indicators towards overbought levels.

I still prefer selling GBP/USD from every upside. Before the Federal Reserve announcement, sterling will be affected by the announcement of inflation figures in Britain.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.