The GBP/USD exchange rate remained near its highest level in nine months in recent trading. It may be volatile this week as a large group of important economic data in Britain and the United States sets the stage for US interest rate decisions from the Federal Reserve and interest from Bank of England.

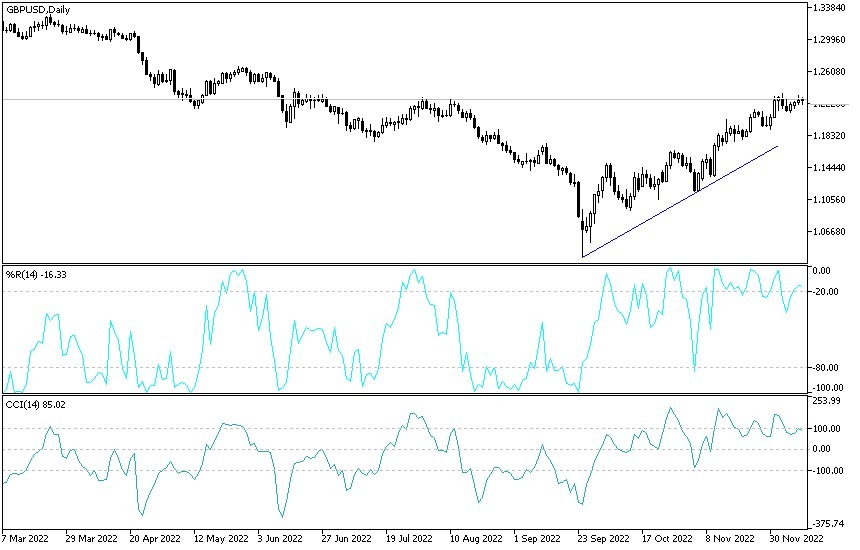

The gains of the upward retracement of the GBP/USD pair brought it to the resistance level of 1.2344, its highest in months. It was subjected to profit-taking sales that pushed it towards the support level of 1.2106, before recovering again in the path of the general trend, reaching the resistance level of 1.2322, and settling around the level of 1.2260.

In general, the dollar has been sold off heavily to benefit from sterling and others since early November when official figures indicated that US inflation eased significantly in October, but whether this trend can continue until the end of the year will depend largely on the data and decisions to be released.

Commenting on this, Lee Hardman, FX Analyst at MUFG, said: “While we are confident that the US dollar has now peaked along with US inflation, and we expect both to weaken next year, there is an intrinsic risk that CPI results will And the decisions of the Federal Open Market Committee (FOMC) will put short pressure on the US dollar,” and the analyst added, “A stronger reading of core inflation will be the most disruptive outcome for the markets.”

Today's US inflation numbers for November are the most important this week because of their ability to influence Fed policymakers' judgments about the need to raise additional US interest rates, details that will be revealed by new projections announced on Wednesday.

Inflation Remains High

US PPI data released on Friday warned of upside risks as the economic consensus looks to increase US consumer price inflation by 0.3% in November and an annualized inflation rate falling from 7.7% to 7.3%, although the core inflation figure is likely to be more important. The latter overlooks changes in energy and food costs, so it is believed to be a better reflection of domestically generated inflationary pressure while the economists' consensus indicates that it is likely to rise at a steady pace of 0.3% in November and by 6.1% for the year ended.

For his part, US Federal Reserve Chairman Jerome Powell said in a recent speech: “While the US inflation data for October received so far showed a pleasant surprise to the downside, this is one-month data, which followed upside surprises over the past two months.” He added that “low months in data were often followed by renewed increases. It would take significantly more evidence to provide comfort that US inflation is indeed declining. By any standard, inflation remains very high.

Overall, today's inflation data and the Fed's decision on Wednesday are bookended on both sides by a flood of data from the UK on Monday and Tuesday as well as the Bank of England's interest rate decision on Thursday.

GBP/USD forecast today:

- GBP/USD peaked last week at 1.2344 and the market appears to be consolidating around the 50% retracement of 1.2295 from the full move down from the May 2021 peak.

- It had a strong rally during Q4 but will soon encounter the moving average of 55 weeks at 1.2450 and we think it will struggle in this vicinity, here is the end of May high at 1.2667.

- Uptrend support is a bit further away at 1.1800, but the 4-hour cloud support between 1.2180 and 1.2120 provides near-term support levels to watch.

In general, the Federal Reserve is expected to raise the US interest rate by 50 basis points on Wednesday, which may lead to some recovery in the dollar. Sterling will be affected today by the announcement of job and wage numbers in Britain and expected statements by the Governor of the Bank of England. The US dollar will be affected by the announcement of US inflation figures through the US Consumer Price Index reading.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.