The performance of the GBP in November ends on a solid base against the dollar and the euro, but there is a clear uncertainty among analysts about how the next month of December will happen.

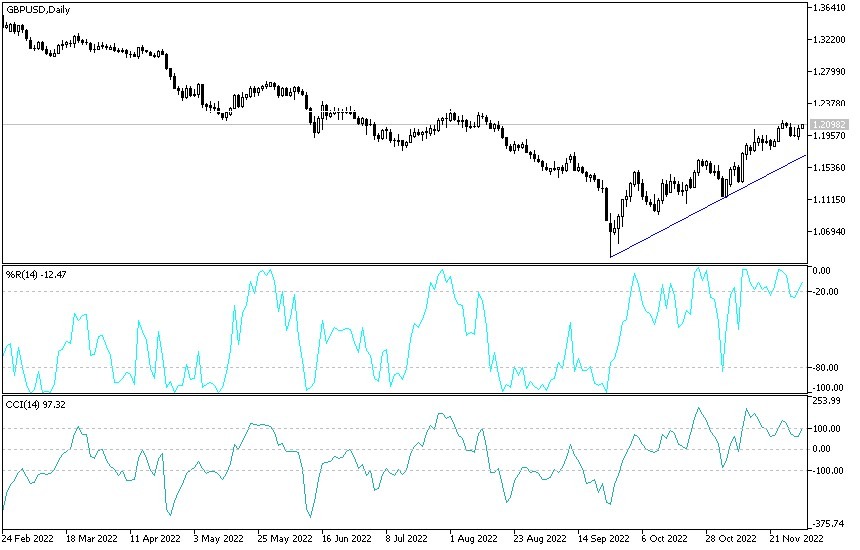

The GBP/USD pair fell to the support level of 1.1900 yesterday, amid the recovery of the US dollar against the other major currencies. It settled around 1.1950 at the time of writing the analysis. By performance, the pound-to-euro exchange rate appears to end slightly in November versus the euro (-0.18% as we move through the last session) but is nonetheless 2.20% higher than its lowest point. It was reached in the wake of the received interest rate decision and policy report. Cash from the Bank of England badly. The GBP/USD exchange rate is looking to post one of its strongest monthly gains ever after ending November 4.55% higher, meaning it has advanced 15.5% since its September low.

However, the movement of forex foreign exchange rates has been difficult to predict over recent days with so many drivers involved, and analysts seem increasingly uncertain about what the next few weeks will bring. This makes market conditions difficult for those readers with imminent international payment decisions and underscores the need to be nimble and react to market movements. “The world of forex has been volatile lately,” describes Daraj Maher, Head of Research for the Americas at HSBC. “This currency volatility is a symptom of a trend that is ending but where the market is grappling between deniers and acceptors.”

The big trends of recent times have been the outperformance of the dollar and the underperformance of the pound sterling. Accordingly, Paul McKell, forex analyst at HSBC, says: “The US dollar has performed very well over the past eighteen months, but a number of forces that pushed it towards its highest valuation in decades have seen a decline.” “After a few volatile months after a year of underperformance, the tide may turn for the better for Sterling. Structural vulnerabilities will not turn around completely overnight, but risks are priced better at foreign exchange levels and interest rates.”

If HSBC is right, and the US dollar and British pound are to see their fortunes turn, then it is likely that more randomness in the FX markets over the coming days and weeks leading up to 2023 will give way to larger trend trends. In general, the news coming from China will be particularly important during the coming days and weeks, with the rise of “risk” currencies, amid expectations of a gradual end to the zero-Covid policy in the country. However, this was challenged on Monday in light of the weekend protests against any return of the restrictions, but by Tuesday the mood swung again as the authorities confirmed they were indeed changing policy. The pound tends to outperform in times of positive sentiment, so headlines about China's reopening have been supportive, especially against the greenback.

Forecast for the pound sterling against the US dollar today:

- The GBP/USD is still stable below the psychological resistance level of 1.2000, supporting the bears for further downward movement.

- The pair is testing the important support levels 1.1775 and 1.1640 to confirm the bearish shift in the currency pair.

- According to the performance on the daily chart, testing the resistance 1.2100 will be important to confirm the bulls' control again.

- Overall, Friday's release of US labor market data will be another near-term event that has an impact on markets as investors try to gauge whether the US economy is really slowing down.

The greenback could potentially come under fresh pressure if the data is weaker than expected, but given the extent of the currency's recent weakness, the risks seem pivotal towards a strong return in the near term if the data is stronger than expected.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.