- The GBP/USD retreated from six-month highs last week as deteriorating economic data and hawkish central banks sent risky assets crashing.

- Sterling could benefit this week if the upcoming holiday period cools the speculative market.

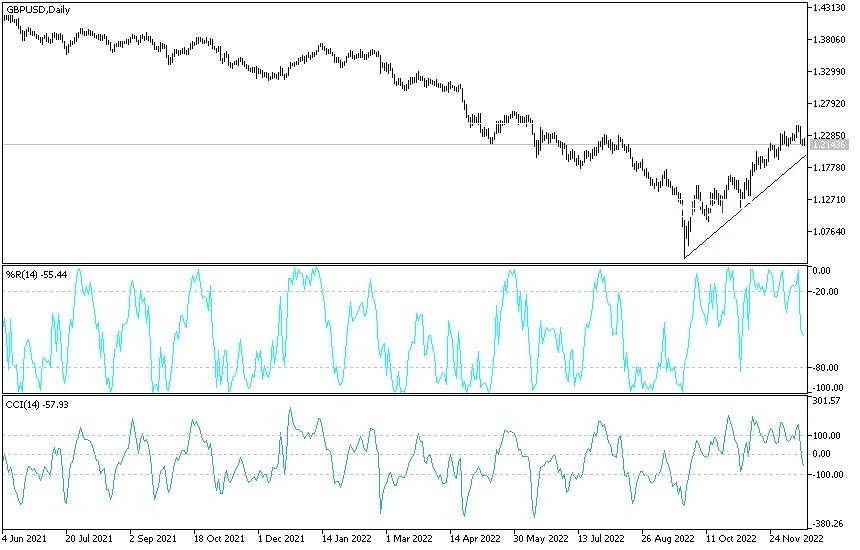

- For the third consecutive day, the price of the GBP/USD currency pair was exposed to selling operations that pushed it towards the support level of 1.2120, before settling around the level of 1.2145 at the time of writing the analysis, waiting for anything new.

Overall, the pound gave up much of its gains this month against the dollar last week when risk currencies came under pressure along with equity and bond markets after unequivocal hawkish messages from the Federal Reserve (Fed) and European Central Bank (ECB) in the halving. Both warned that financial markets are likely to underestimate how much interest rates will rise in the future. This boosted the dollar and the euro, while the pound was punished by a split in the Bank of England's (BoE) Monetary Policy Committee vote, as two members voted to leave the bank rate unchanged.

Commenting on the performance of the GBP/USD, Jason Hunter, an analyst at JPMorgan, stated that “an important group of short-term support is found at 1.1640 - 1.1740.”

Overall, the hawkish policy messages from the US Federal Reserve and the European Central Bank affected risk assets and the GBP/USD rate just as a series of official figures warned of deteriorating economic conditions in the US and Britain with retail sales figures for November and PMI polls.

All of this was an open call for more risk-off positions in the speculative market last week but with the Western Hemisphere, Christmas holidays approaching. Positioning dynamics may be about to become more supportive of the GBP in the coming days. This is large because the British pound has been one of the more popular “short” trades in the speculative market throughout the year. This will likely benefit from any book profit-taking or squaring that is done to reduce risk in the festive and New Year periods.

“Liquidity is likely to decline during the holiday period. Currency movements can be significant when liquidity is low, ” commented Joseph Capurso, an analyst at the Commonwealth Bank of Australia.

“The GBP/USD could consolidate this week after taking a step down this week. There are no important economic data releases this week. Accordingly, GBP/USD can take its cues from the trends of the US dollar,” he added.

With trading activity likely to be subdued over the coming days, there is potential for only limited response to this week's showings from the US economic calendar, which includes the latest reading of personal consumption expenditures (PCE) inflation measures on Friday. This is the Fed's preferred measure of inflation, as economists will be looking to see it confirm the declines seen in the last two official CPI readings.

GBP/USD Forecast

According to the performance on the daily chart below, it seems clear that the bears will control the direction of the GBP/USD pair. There will be an opportunity to move towards the 1.2000 psychological support if the currency pair moves below the 1.2100 support level, which is currently closest to it.

On the other hand, over the same period of time, the bulls will not control the trend without breaking the 1.2460 resistance again. In light of the absence of important economic releases in the economic calendar, investor sentiment will have an impact on performance.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.