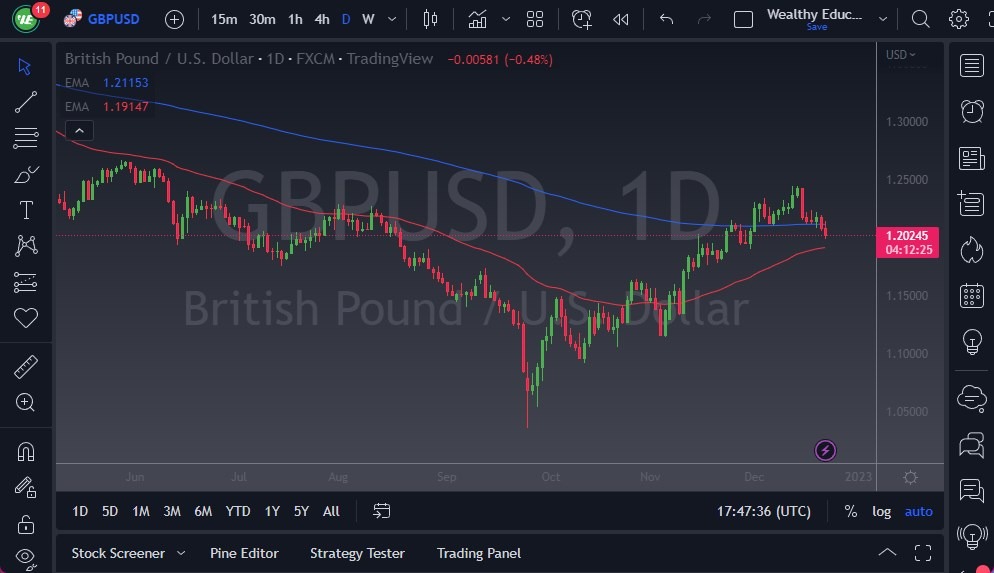

The GBP/USD initially tried to rally during the trading session on Thursday but gave bank gain at the 200-Day EMA as it looks like the pair is starting to roll over again. The 1.20 level underneath will be crucial, and if we can break it down below there, and of course the 50-Day EMA which is right around the same place, we could see this market breakdown quite a bit further.

In the meantime, you should look at this through the prism of being stuck between the 50-Day EMA and the 200-Day EMA, meaning that we are probably going to get a squeeze sooner or later, but as we head into the holiday trading environment. The lack of liquidity will be a major issue to deal with, and therefore we may just simply have a market that stops moving overall.

Waiting for a Breakdown

- I still favor the downside, because we have a lot of concerns out there when it comes to the global economy, as we are almost certainly going to continue to slow down.

- Furthermore, the British economy itself is going to be in particularly bad shape, so it does make sense that the pound really takes a beating against the greenback.

- In this environment, I think we are right for some type of breakdown, but it may have to wait until January. However, we may also have a situation where the lack of liquidity makes the move happen much quicker than anticipated.

If we turn around and rally, it is obvious that the 1.25 level has become a major barrier, as it is not only a large, round, psychologically significant figure but where we had placed the last high in the market. Because of this, I think you need to be cautious about the area if we get up there because it could lead to the next leg higher. However, we would need to see the US dollar selloff in general at that point, so we will have to wait and see how that plays out. With, I do favor the downside, and think that we could be setting up for a big move if we get enough sustained bad news or interest rates rise in the United States. The Federal Reserve has reiterated its hawkish stance, so now is time for the markets to follow.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.