Since the start of trading this week, the price of the EUR/USD currency pair has been moving in a narrow range between the 1.0575 support level and the 1.0660 resistance level. The currency pair is looking for strong factors to move in one of the two directions. The currency pair interacts amid the factors of global central bank policy and the future of energy in Europe, especially with the continuation of the Russian-Ukrainian war. The price of the euro is still benefiting from the European Central Bank's recent assertion that it is ready for further tightening until inflation is contained in the bloc. On the economic side, data from the German statistics office Destatis showed that producer price inflation in Germany fell more than expected in November, reaching its lowest level in nine months amid a slowdown in energy price growth.

According to the advertiser, German producer prices rose 28.2 percent (year-to-year) in November, slower than the 34.5 percent increase in October. It was also slower than the 30.6 percent increase economists had expected. Moreover, the latest rate of inflation was the weakest since February, when prices rose by 25.9 percent. The strong overall inflation in November was largely caused by a 65.8 percent jump in energy prices amid rising costs of natural gas and electricity. However, the growth rate eased significantly from 85.6% in October. Excluding energy, German producer prices rose 12.7 percent year-on-year in November, while falling 0.2 percent from the previous month.

Among other components of the PPI, prices of intermediate goods increased by 13.8 percent, and prices of capital goods increased by 7.8 percent. Consumer prices alone recorded double-digit annual growth of 11.1 percent. On a monthly basis, German producer prices fell 3.9 percent in November, after rising 4.2 percent in October. Prices fell for the second month in a row.

Survey results from the IFO institute showed confidence among German exporters improved slightly in December, as they expect better demand conditions for the auto and electricity sectors. Accordingly, the IFO Export Expectations Index rose to a 6-month high of 1.6 points, from 0.9 points in November.

Ifo said German manufacturers are cautiously optimistic as they head into the new year.

Despite a slight decrease from the previous month, the auto industry still expects significant growth soon. After the November setback, the electric industry and beverage producers are increasingly seeing international business as opportunities. However, the chemical industry expects export sales to decline, as does the metals industry. The furniture industry also remains pessimistic about its overseas business.

EUR/USD Forecast

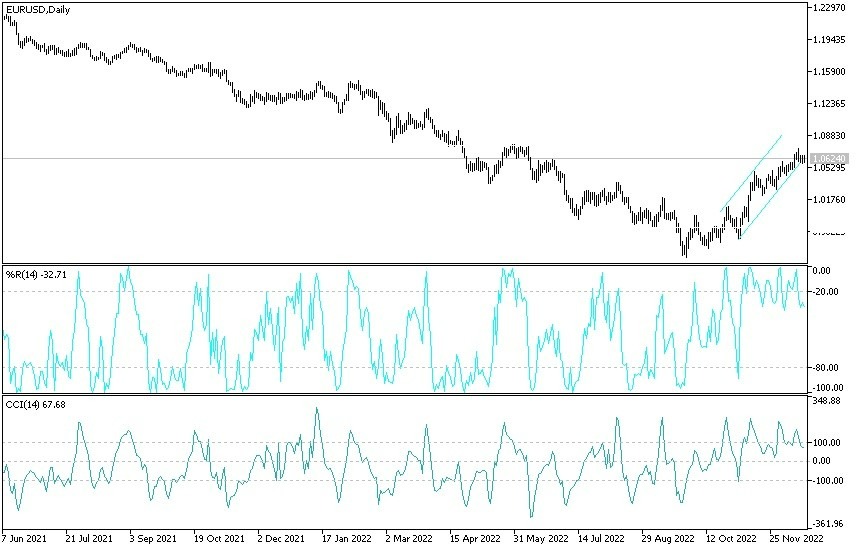

There is no change in my technical view of the performance of the EUR/USD currency pair, only the performance on the daily chart. The performance is neutral with a bearish bias, which will strengthen if it moves toward the 1.0570 and 1.0490 support levels, respectively. On the other hand, and according to the performance over the same time period, the move will have higher stability, to confirm the bulls' control. Until now, I still prefer selling the Euro-dollar from every rising level. The performance of the US dollar will be affected today by the release of the US Consumer Confidence reading.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.