The EUR/USD exchange rate reached an eight-month high last week. It could struggle for momentum this week if profit-taking or squaring accounts ahead of the holidays causes the speculative market to reduce its exposure to the euro, which is one of the few centers of " net purchase” in the market. The EUR/USD currency pair, at the beginning of this week's trading, settled in a narrow range between 1.0658 and 1.0576 and settled around 1.0606 at the time of writing.

Overall, the euro benefited last week when the second drop in US inflation left the dollar unable to capitalize on when the Federal Reserve raised its inflation forecasts for next year as well as a potential peak in US interest rates. Accordingly, the price of the EUR/USD pair reached an eight-month high above 1.07 shortly after the Fed's decision last week, but its short-term rally faded when the European Central Bank (ECB) outlined its most hawkish policy stance yet. It also battered the stock and bond market in the process.

“The ECB is primarily focused on destroying demand in the eurozone economy in order to bring down inflation, although a lot of the inflationary pressures in the eurozone have stemmed from higher energy and food prices,” said Jane Foley, currency analyst at Rabobank.

"Given the risk that the ECB's mission to 'further' extend policy tightening threatens to squeeze the life out of the economy, the euro price may struggle to extend its recent gains into 2023," she added.

Overall, ECB Governor Christine Lagarde's warning that "interest rates will still have to rise significantly at a steady pace to reach levels constrained enough to ensure a timely return of inflation to our medium-term target of 2 percent”. The statement indicated that the European Central Bank intends to use its interest rate to depress inflation outside the eurozone regardless of the costs to the economy, a situation that may leave some investors wary of the euro.

And while the past week revolved around central bank policy decisions, squaring the position before the holidays may be more influential in the coming days despite the presence of uncertain effects on the euro. It recently became the only “long position” for the speculative market among the G10 currencies. The risk this week is that speculative market participants reduce their exposure to trade in the illiquid market conditions that usually prevail before the end of the year and in the case of the euro, this means less “long” exposure and a headwind for the EUR/USD rate.

For his part, Jordan Rochester, an analyst at Nomura, wrote in a research briefing that “We expect the euro to continue to rise higher in the coming weeks, and we remain long in EUR/USD (target 1.10 at the end of January).”

“However, we will watch whether there are any challenges to the US peak inflation narrative, whether European growth takes an (even) worse turn and whether the UK remains a canary in the coal mine for central bankers elsewhere as the Default risk,” he added.

With trading activity likely to wane over the coming days, there is uncertainty about the likely response to this week's showings from the US economic calendar. which It the latest reading of personal consumption expenditures (PCE) inflation measures on Friday. This is the Fed's preferred measure of inflation as economists and financial markets look forward to seeing it confirm the declines seen in the last two official CPI measures of inflation.

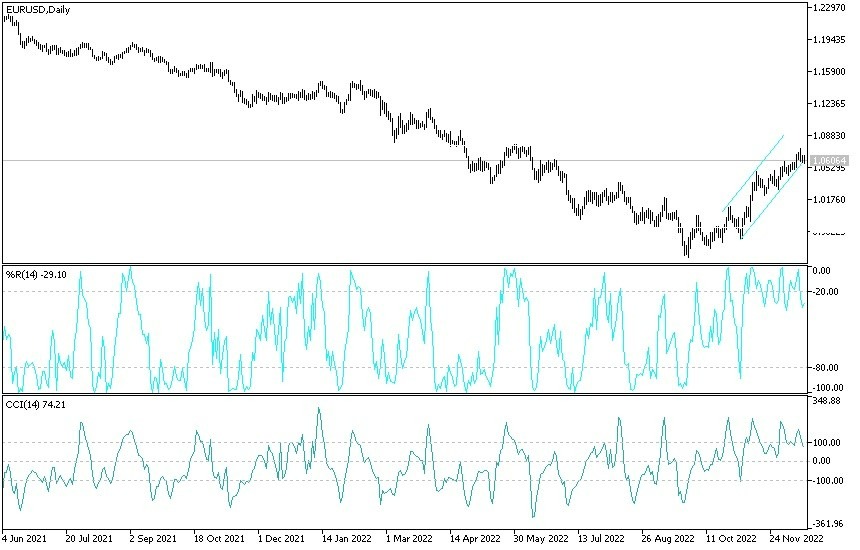

EUR/USD Forecast

The neutrality of the recent performance of the EUR/USD pair may bring profit-taking sales to the currency pair at any time, especially if the euro did not gain momentum to achieve more. We saw the lack of reaction to the positive improvement in German companies' sentiment at the beginning of the week as evidence. I still prefer to sell the Eurodollar from every rising level, and the general outlook for the currency pair will change to bearish if it moves towards the 1.0531 and 1.0480 support levels, respectively.

On the other hand, according to the performance on the daily chart below, the 1.0710 and 1.0800 resistance levels will be important for the bulls to rule for a while, and at the same time, they will move the technical indicators towards overbought levels.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.