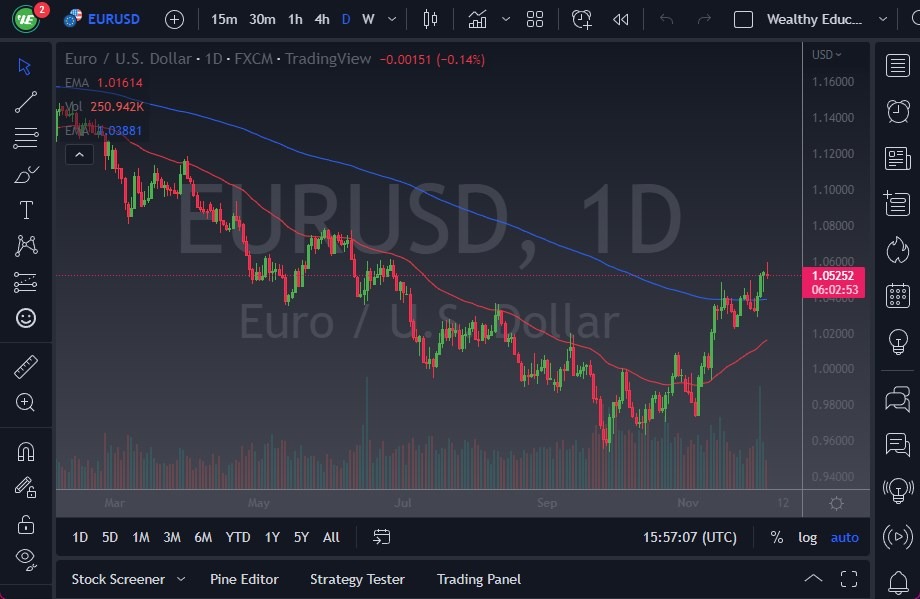

- The EUR/USD initially rallied during the trading session on Monday, reaching the 1.06 level before turning around.

- It looks as if the market is struggling into the beginning of the week, it looks like we are running into exhaustion as we may have gotten too far ahead of ourselves.

- Furthermore, the market is likely to continue to be a bit cautious at this point, as we are heading closer to the FOMC meeting in the United States next week, and people will be watching that very closely.

Furthermore, the interest rate market has perked up a bit, showing signs of strengthening again, and if interest rates in the United States start to rise, that is going to drive the value of the US dollar higher. This has been one hell of a rally as of late, but now we are starting to show signs of exhaustion. The meeting next week, and perhaps more importantly, the statement afterward, could have a major influence on where we go next. Furthermore, it should be kept in the back of your mind that it is the last bit of information that truly matters, except for the ECB meeting the next day, which will greatly influence where this pair goes.

Looking to Short this Market

As we head toward the end of the year, we will have to worry about liquidity, and therefore moves could be extreme. On the other hand, moves might be very slow. You never really know going into the end of the year, begins each year is different but it’s worth noting that the action may become a little bit noisy. While we have seen a nice rally over the last couple of months, the reality is that the Euro is still very beaten-down over the last couple of years, and it’s probably even more valuable to think about it in terms of absolutism: the Euro peaked during the Great Financial Crisis.

It’s been that long since we hit the highs, and although we have had significant rallies from time to time, the reality is that since the middle of that mess, you have been paid to short the Euro over the longer term. I realize that’s a bit of a stretch, but it does suggest that perhaps even though we have rallied, it might be time to start shorting again. Interest rates in America rising certainly help.

Ready to trade our Forex daily analysis and predictions? Here are the best Forex brokers to choose from.