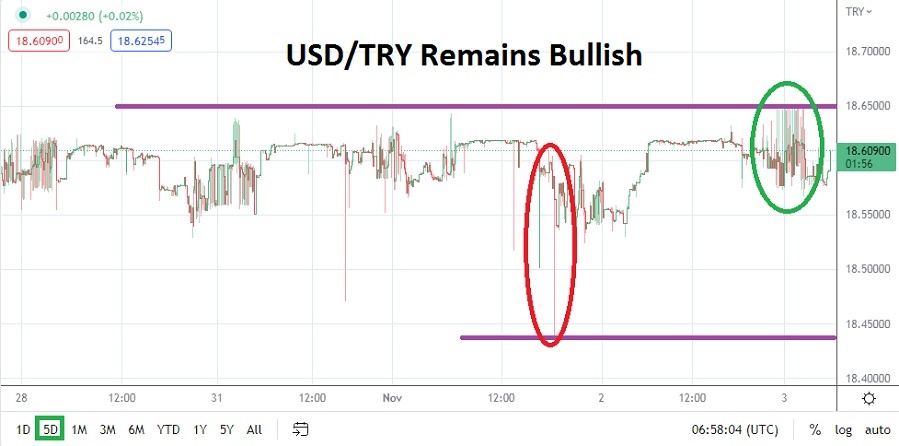

The USD/TRY remains in a bullish trend which has the feeling of an impossible direction to defeat; yesterday’s slight selling pressure was met by a swift stronger reversal higher.

The USD/TRY is near the 1.61700 mark as of this writing. In late trading last night the USD/TRY came within the 164.80000 ratio, this after selling off before the U.S Federal Reserve pronouncements. Spikes are often a dangerous part of trading the USD/TRY, and this makes risk management important, but also very hard to determine. One rule of thumb, conservative leverage is a good starting point when pursuing a USD/TRY position.

Consistent Bullish Trend Incrementally Creating New Highs in USD/TRY

Speculators are faced with a tough task if they are able to trade the USD/TRY via their platform brokers. The frequency of spikes downward which happened yesterday for instance, this before the U.S Fed made its monetary policy statement is a constant danger. And this creates a hard question regarding where stop losses should be placed. Traders might have been kicked out of their long positions if their stop losses were too close yesterday, and then left to watch empty handed as the USD/TRY reversed upwards and hit new record highs.

Experienced traders of the USD/TRY have seen this type of price action before. While new incremental highs have been a constant in the Forex pair, patience and the ability to hold onto a trade remain difficult. Technically pinpointing the precise moment the USD/TRY will rise remains a guessing game, except to say with the ‘gift of time’ higher realms are frequently seen.

- Yesterday’s reinforcement of a hawkish U.S Federal Reserve interest rate policy is likely to serve as support for the USD/TRY – meaning the currency pair will find it difficult to escape its bullish trend near term.

- Volatility and spikes are part of the USD/TRY trading; realistic take profit targets are needed with wide stop losses to pursue the Forex pair. If a trader uses wide stop losses extremely conservative leverage should be used.

The USD/TRY Track Upwards is Attractive, but Dangerous for Traders

Traders cannot be blamed for pursuing the USD/TRY higher. However, it remains a difficult currency pair to trade because unless the USD/TRY moves suddenly within the chosen direction, time, transaction costs and the risk of sudden spikes downward can prove costly. Buying the USD/TRY remains attractive and if the 18.62000 to 18.64000 realms are challenged again in the short-term, then new record highs may soon be produced again. Until fiscal and economic policy changes occur in Turkey, the Turkish Lira will likely remain a currency in peril.

Turkish Lira Short Term Outlook:

Current Resistance: 18.64800

Current Support: 18.58400

High Target: 18.66200

Low Target: 18.56100

Ready to trade our free Forex currency signals? Here are some excellent Forex brokers to choose from.