With the return of the US dollar's recovery, the GBP/USD currency pair was the most negatively affected, and it fell from the resistance level of 1.1600 to the support level of 1.1333 at the time of writing the analysis. The gains of the US currency came amid cautious anticipation of the markets and investors to announce US inflation figures, which have a reaction on the policy path of the US Federal Reserve. Amid the current sterling performance, MUFG forex analysts are selling the British pound against the euro, saying in a new note that the recent update of the Bank of England's policy has strengthened their conviction in this trade. “The mix of tighter monetary and fiscal policy will exacerbate the UK recession and will weigh on the pound,” says Derek Halpenny, Head of Market Research at MUFG.

Pound continues to decline

Sterling fell against all other major currencies on Thursday, 3 November after the Bank of England raised interest rates by 75 basis points but warned that the British economy would suffer a recession for eight quarters if it stuck to market expectations by pushing further hikes significantly. This was accepted by the market as a signal from the bank that it will not raise interest rates as much as expected as it heads towards a policy update, reassessing expectations that led to the pound's decline today.

For some analysts, this reassessment of expectations will continue to weigh on sentiment towards sterling for some time to come, strengthening their expectations for a subpar performance of the British pound going forward. Analysts at MUFG maintain “the idea of trading the EUR/GBP after the pair rebounded over the past week after failing to break below 0.8600 on a sustainable basis.” MUFG sees bounces as likely to be transient. The Bank of England analyst added: “The Bank of England has given a very strong signal that it is not planning to raise rates as much as it has been priced in by the UK rate market. Meanwhile, the updated BoE forecasts highlighted that the UK economy has likely entered a recession and is now expected to last until mid-2024.”

It adds to the unfavorable growth outlook and the diminishing need for the BoE to continue raising interest rates and is expected to be further reinforced by the government's next autumn statement on November 17th. He says the statement is likely to outline plans to raise taxes and cut government spending. A potential risk to trade identified by MUFG is that the ECB is also slowing interest rate hikes, a possible outcome, "a less hawkish policy update than the ECB which dampened expectations for further hikes."

The main topic of global financial markets recently has been rumors regarding the possible easing of China's no-Covid policy, something investors are betting will boost global economic growth and currencies with a strong link to the Chinese economy.

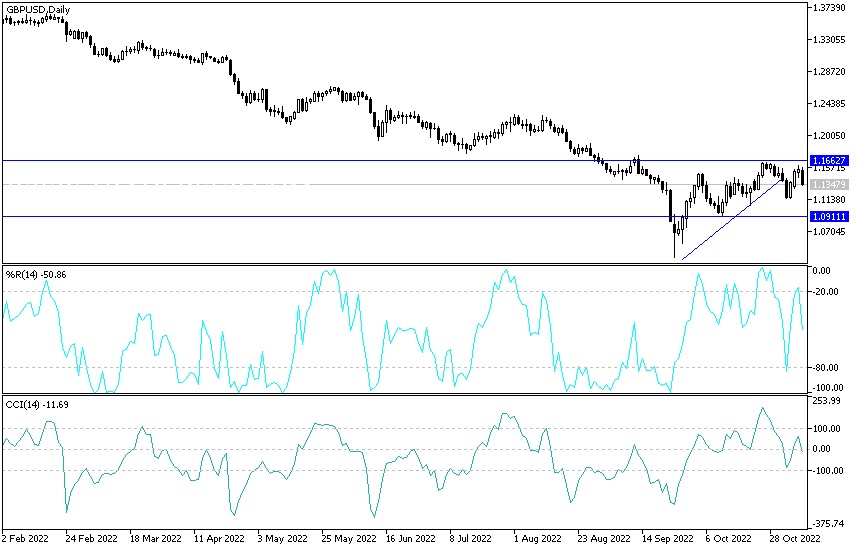

GBP/USD Technical Analysis:

- The GBP/USD may be preparing for a reversal opportunity, as the price is approaching the top of its ascending channel on the hourly time frame.

- The price has just closed above the interesting mid-channel area around 1.1600 and could set its sights on the next upside barrier.

So far the 100 SMA is above the 200 SMA to confirm that the trend has a chance to bounce higher and that the rally is likely to gain momentum from here. However, the stochastic is already in the overbought zone to reflect the fatigue among the buyers, so a shift to the downside means selling pressure is back.

- The RSI has little room to go up before reaching the overbought zone, but the oscillator appears to be leading as well.

- If resistance persists, GBP/USD may resume sliding to the bottom of the channel at 1.1300, which happens to line up with the 200 SMA dynamic inflection point.

Ready to trade our daily Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.