Speculators of the EUR/USD that enjoy volatility are getting plenty of price action delivered on a daily basis. The EUR/USD remains below parity and the currency pair was not able to trade above 1.00000 the entirety of last week. Intriguingly, the inability to climb above the 1.00000 did not even happen as the U.S Federal Reserve was set to deliver their interest rate hike this past Wednesday, when some financial houses may have been expected to wager aggressively on the EUR/USD with buying. Muted buying is intriguing technically.

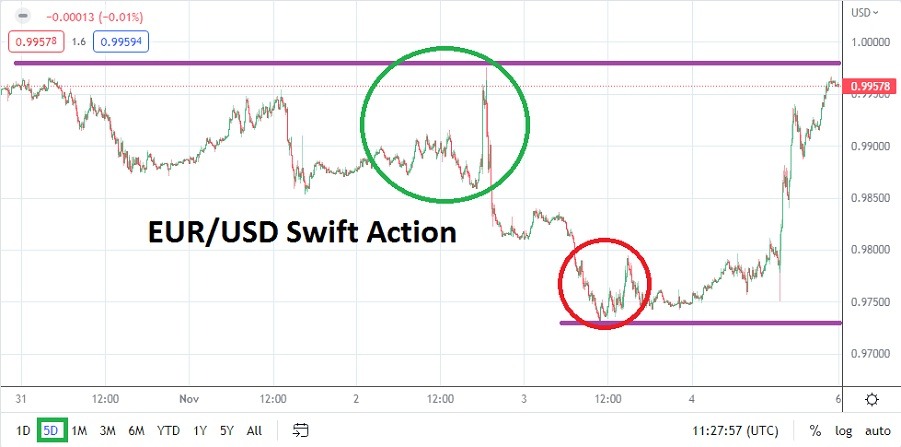

The EUR/USD did climb early on Wednesday to highs near the 0.99750 mark briefly. This upwards momentum was likely based on the notion, which proved to be wrong, that the U.S Federal Reserve would offer more dovish interest rate policy. In fact, the U.S Fed not only raised its interest rate by the expected 0.75% addition, but essentially said, it is too early to begin thinking about a change of interest rate policy.

EUR/USD trading below the 1.00000 may entice Bullish Speculators, but should it?

After the U.S central bank kept its monetary policy enflamed with ‘red hot’ rhetoric as it continued to sound alarm bells regarding inflation, the EUR/USD sank quickly. The 0.98300 mark was quickly seen on late Wednesday via selling. And then on Thursday after the Bank of England recession chatter being delivered along with another interest rate hike too, the EUR/USD sank further to a mark of nearly 0.97250.

The European Central Bank did raise its interest rate nearly two weeks ago. However, the ECB is looked upon as being rather unimpressive regarding its rhetoric regarding the battle to engage inflation throughout Europe. The EUR/USD has now been battling parity since the middle of August and the inability to sustain highs over 1.00000 seems to becoming the norm. Behavioral sentiment remains fragile and perhaps financial houses are getting used to a range of 0.97500 to 0.99500. Taking advantage of resistance has likely proven worthwhile for some traders.

- Choppy conditions have been fast in the EUR/USD, and traders looking for upwards momentum when support is touched may continue to wager. The mark of 0.97500 looks to be a technical area that buying has manifested.

- Yes, the EUR/USD can certainly trade above the 1.00000 ratio, but resistance does look rather strong above the 1.00800 mark.

Range Trading and a New ‘Normal’ for the EUR/USD

The EUR/USD still may need attitude adjustments for some speculators who believe the currency pair is oversold. In the long-term bullish speculators will likely be proven correct, but until sustained price action is attained above the 1.00000 lasting longer than a handful of days, perhaps even a few weeks, the price of the EUR/USD may simply range within its current realms. The shadow of the U.S Federal Reserve remains strong, particularly as they threaten more hikes to come over the mid-term.

EUR/USD Weekly Outlook:

Speculative price range for EUR/USD is 0.96800 to 1.01000

Can traders take advantage of the relatively new and low range of the EUR/USD? Risk management is essential to guard against sudden flurries of value changes. The EUR/USD has been in a long-term bearish trend and although some speculators may feel like the time has come for a shift in technical direction, this might not occur in the near-term. Trading conditions on global markets remain nervous and economic clouds continue to create pressure in the European Union. The EUR/USD did move to a low of nearly 0.97250 last week, which came within sight of lows seen the previous week. Traders wanting to be buyers when support is tested cannot be blamed, but they should be careful.

The EUR/USD may be starting to demonstrate durable support for speculators. The fact that the EUR/USD was able to climb higher on Friday and finish near its high for the week is of interest technically. If the EUR/USD opens with solid gains to start this week, it is not out of the question the EUR/USD could climb above parity and challenge highs seen on the 26th of October, near the 1.00950 mark.

Looking for quick hitting results may prove to be the best risk taking strategy in the coming days. Traders should also keep in mind the U.S mid-term elections that will take place this Tuesday and could cause volatility if the results produce a surprise.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.

Ready to trade our Forex weekly forecast? Here’s a list of some of the best Forex trading platforms to check out.