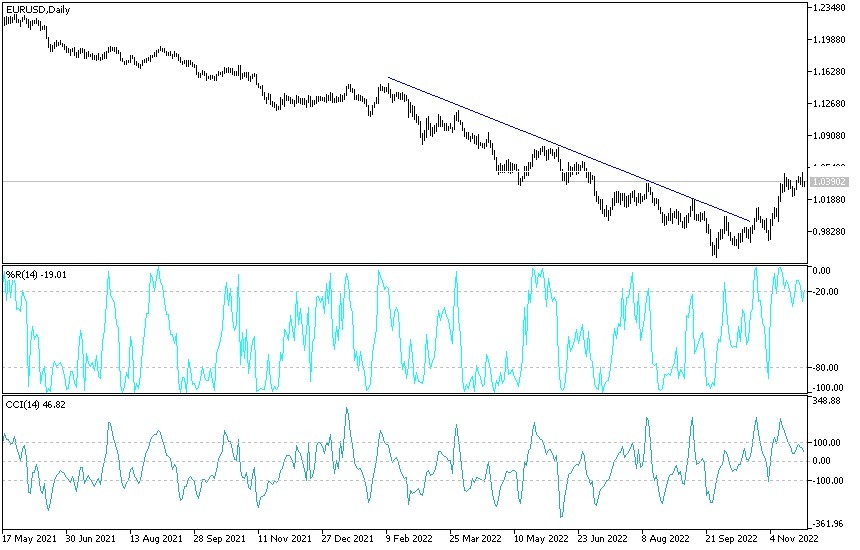

- The EUR/USD exchange rate benefited greatly from the rise in risk assets in the last quarter, but its recovery was recently halted by technical resistance around 1.04 on the charts.

- It could give way this week to losses that pull the single European currency back towards 1.0303 or less in the coming days.

- The recent rebound gains for the EUR/USD currency pair extended to the 1.0496 resistance level, and it stabilized after profit-taking sales around the 1.0340 support at the time of writing.

The European single currency - the euro - has reversed nearly half of this year's losses against the dollar since financial markets took an optimistic view on the outlook for China in its ongoing battle with the coronavirus and for the United States as the Federal Reserve (Fed) attempts to beat inflation. But in both cases, the market optimism may have been premature, and events this week are likely to clarify that with possible negative repercussions on the EUR/USD price, which is better to remain above the 23.6% Fibonacci retracement of its November rally around 1.0303. Commenting on performance.

“We can't rule out EUR/USD trading back to 1.0480/1.0500 again (although the reasons for that are far from clear) but we repeat that the second half of the week could push EUR/USD back to the 1.02 area, ” stated an analyst.

The euro was on alert at the beginning of this week's trading as restrictions related to the Coronavirus and public protests against it in parts of China confirmed that investors were premature in thinking earlier this month about the potential effects on asset prices of reopening the second largest economy in the world. The continued economic turmoil in China is dampening the economic outlook in the Eurozone in some respects because the world's second-largest economy is also Europe's second-largest export market by some measures, hence the soft start to the euro yesterday.

But developments in China are likely to set the mood around the opening of the week. Wednesday's release of European inflation figures and subsequent events in the US are likely to be the most important for the single currency and short-term EURUSD price outlook.

“EUR/USD could take some direction from the CPI for November on Wednesday. Market prices indicate that there is no consensus yet on the size of the interest rate hike at the European Central Bank meeting on December 15 at a price of 62 basis points. euro. Conversely, a reading below the consensus could weigh on the euro if market prices decline,” added the analyst,

Wednesday's inflation figures and their possible implications for the European Central Bank's (ECB) interest rate outlook are the week's main domestic events. The single European currency is also likely to be sensitive to a whole host of important economic data and other risks emerging from the United States.

EUR/USD Forecast

Despite the profit-taking sales that took place yesterday, however, the price of the EUR/USD currency pair is still in an upward retracement path, according to the performance on the daily chart, and as I mentioned before that the move towards and above the 1.0400 psychological resistance confirms this. Considering that level, the 1.0450 & 1.0520 resistances are enough to push the technical indicators towards overbought areas. On the other hand, and for the same period of time, breaking the support level at 1.0230 will be important for the bears to control the trend. I still prefer to sell the EUR/USD from every bullish level.

Ready to trade our daily Forex forecast? Here’s a list of some of the best Forex brokers to check out.