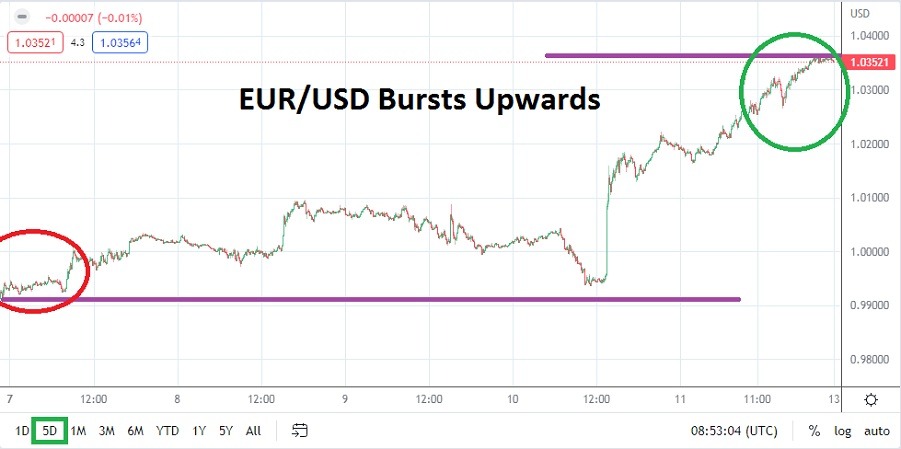

The EUR/USD climbed above parity last week and sustained upwards momentum, this as the weekend came into sight while the Forex pair continued to challenge resistance.

The EUR/USD will start this week of trading near the 1.03500, having accomplished not only a climb above parity, but also having sustained its bullish trend going into the weekend. The last time the EUR/USD traded near its current value was on the 11th of August, when a flourish of momentum upwards in the second week of that month exhibited brief bullish optimism before drifting back into the long-term bearish trend the EUR/USD has suffered.

The ability of the EUR/USD to climb above the 1.00000 level this time around may be different. While it may not be time to declare the creation of a new bullish trend for buyers to continuously speculate on, there does seem to be a shift in trading sentiment taking place. The upwards direction of the EUR/USD has mirrored most other major currency pairs teamed against the USD. Last week’s late dose of ‘better’ than expected inflation data in the U.S, helped create another spur in the EUR/USD kicking it upwards yet again.

Six Month Charts should be looked at for the EUR/USD to Gain Perspective

As experienced traders know the EUR/USD is still trading at what can easily be perceived as lower values even at the current ratio of 1.03300. While the EUR/USD has traded below parity since the middle of August, this is not a long-time common occurrence. Traders should refresh their perspectives by looking at six month charts.

There will not be a lot of economic data from Europe this week to ‘spin’ behavioral sentiment. Global equity indices remain fragile even though they certainly put in solid gains last week. Europe will see services and manufacturing data from Germany early next week, but this is not likely to stir behavioral sentiment in the EUR/USD too much either. The EUR/USD seems largely reactive to financial institutions positioning their ‘holdings’ according to their viewpoints of the U.S Federal Reserve.

- U.S CPI data increased less than expected last week, this ‘positive’ outcome has increased the notion the U.S Federal Reserve will start becoming less hawkish regarding its interest rate policy.

- The ability to sustain value over the 1.00000 mark on Tuesday of last week, even before the CPI data from the U.S on Thursday was published, is another potential bullish signal for EUR/USD speculators.

Price Velocity and the EUR/USD Move Higher were Quick Last Week

Speculative zeal in the EUR/USD may build in the coming days, but it does not mean the climb achieved by the Forex pair will resemble last week’s solid results. The bursts upwards in the EUR/USD demonstrated since the 3rd of November has certainly been solid, but simple one way avenues do not exist in Forex, traders need to remain cautious and practice risk management. While the 1.04000 ratio and above now may look very attractive, trading conditions may make this task harder to accomplish than hoped.

EUR/USD Weekly Outlook:

Speculative price range for EUR/USD is 1.00600 to 1.06300

Support should be watched attentively by traders this week to guard against potential selling reactions in the EUR/USD from financial houses which may believe the currency pair has been overbought. When the EUR/USD opens on Monday the 1.03000 is a logical ratio to watch carefully, if this level can hold its value throughout the day, this would be another positive signal for the EUR/USD.

It should be remembered that on Thursday of last week the EUR/USD was still trading under the 1.00000 for a moment as selling increase, perhaps via profit taking by large financial houses. However support actually did rather well late last week and when challenged, buying momentum did show exuberance in the EUR/USD.

The EUR/USD is now within sight of intriguing resistance. The sudden change in behavioral sentiment has been swift enough to cause surprise among many speculators. The ability of the EUR/USD to now have the 1.03700 value as a legitimate target is attractive. If the 1.03900 mark sees quick testing early this week, the EUR/USD could easily climb above 1.04000. The currency pair saw a lot a fast price velocity last week and speculators should be prepared for more as equilibrium is sought. Risk management is important and should be practiced when wagering on the EUR/USD.

Ready to trade our weekly Forex analysis? We’ve made a list of the best brokers to trade Forex worth using.