- The price of the USD/JPY is now on the cusp of the 150.00 historical psychological resistance, the highest in 32 years, at which time markets and investors expect that Japan will take intervention steps to prevent a further collapse in the price of the Japanese yen. This could have negative repercussions on the Japanese economy.

- The US dollar is still stronger with expectations of a US interest rate hike and a good US economic performance despite the tightening policy of the US Federal Reserve.

- On the front, the US central bank's policy tightening.

James Bullard, President of the Federal Reserve Bank of St. Louis, said he expects the US central bank to end its "front-loading" of aggressive rate hikes by early next year and switch to keeping policy sufficiently restrictive with small adjustments as inflation slows. “You have to think about the reasonable level,” Pollard added in a TV interview with Kathleen Hayes in St. Louis, noting that he does not currently see the need to pay interest rates higher than officials have already expected.

The goal is to move to a "certain level of meaningful constraint" that would push inflation down. "But that doesn't mean you're going to go up forever," he said.

The FOMC in September forecast a rate hike to 4.5%-4.75% next year, which Bullard said could put downward pressure on inflation. The Fed Index is currently in the target range of 3% to 3.25%. The Federal Reserve is expected to raise interest rates by 75 basis points at its meeting on November 1 and 2 - the fourth consecutive increase of that size - as central bankers seek to cool the hottest inflation in four decades. Investors are also betting on the possibility of another increase of this magnitude in December, as markets see interest rates approach 5% next year to curb rates.

While the committee was "carrying forward" aggressive increases to try to quickly catch up with inflation near a four-decade high, Pollard said he was looking to switch to more normal policy. He added that “In 2023, I think we will be closer to the point where we can manage what I would call normal monetary policy.”

Bullard added that the outcome of the November meeting was "fairly priced in the markets" at 75 basis points, although he would prefer to wait until the meeting to decide his preference for the volume of movement. And for December, he didn't want to "prejudge" what he would support at that meeting, though he repeated comments a few days ago that the Fed could withdraw the expected tightening in 2022 from 2023, leaving the door open to Probability of 75 basis point rise.

Pollard has been among the Fed's most hawkish officials this year, and at the March meeting he differed in favor of a further rate hike. He was the first to publicly propose a 75 basis point increase, which has become routine this year in the fight against inflation. Pollard also said that once a capped rate is achieved that puts pressure on prices, the policy committee can pause rates or make small, upward adjustments if the data comes in poorly.

"It doesn't mean that there won't be more adjustments, but it will be more based on the data coming in rather than us trying to get out of scratch and get to a reasonable level," he added.

Officials only began hiking in March and have since raised rates by three percentage points in the fastest tightening campaign since the 1980s.

Core consumer prices in the United States, which exclude food and energy, rose 6.6% in September from a year ago, the fastest since 1982, according to a Labor Department report last week. This continues a worrying pattern for policy makers after the gauge accelerated in August as well. Federal Reserve officials have described the US labor market as unhealthy narrow. Nonfarm payrolls increased by 263,000 in September and the unemployment rate fell to 3.5%, matching a five-decade low.

USD/JPY Forecast

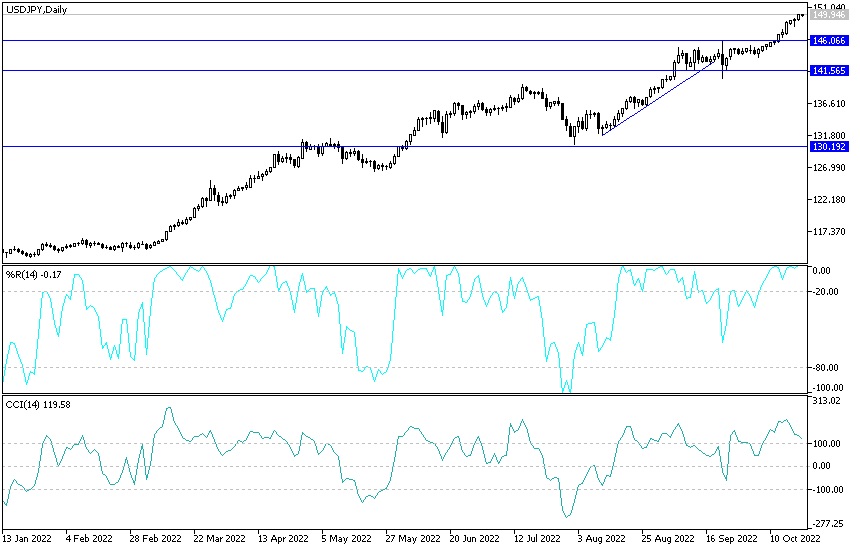

The general trend of the USD/JPY currency pair is still stronger, and the bulls' control is gaining momentum by testing the psychological resistance level of 150.00. At the same time, the technical indicators are moving towards sharp overbought levels, and investors are expected to capture short positions to take profits at any time. The closest resistance levels for the pair are currently 150.30 and 151.20, respectively.

I still do not prefer buying from those record levels. On the other hand, according to the performance on the daily chart, it will be important to break the support levels 147.60 and 146.00 to start new selling operations to change the direction. The US dollar is on an important date today, with the announcement of the number of weekly jobless claims, the reading of the Philadelphia Industrial Index and the US existing home sales.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.