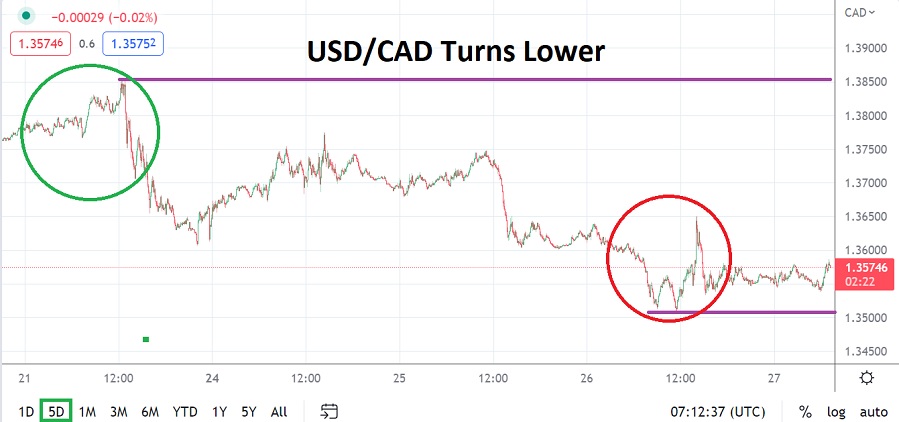

The USD/CAD is near the 1.35900 level this morning, as it has stayed within sight of important one month support ratios. A rather volatile day of trading for the USD/CAD was produced yesterday, this as financial houses anticipated the rate hike from the Bank of Canada. The fluctuations in the USD/CAD were then delivered additional jet fuel sparking price chaos when the BoC only raised their key lending rate by 0.50%, instead of the expected 0.75% hike.

Is the Bank of Canada move a Sign of Things to Come from the U.S Federal Reserve?

The USD/CAD did trade to a depth of nearly 1.35100 late yesterday before reversing higher, but the currency pair has stayed within sight of lows seen on the 4th and 5th of October when the 1.35050 juncture had a flirtation. The USD has been slightly weaker across plenty of the Forex world the past few days, this as financial analysts debate what the U.S Federal Reserve is going to do next.

The Bank of Canada’s rather conservative hike of only half a percent to the 3.75% mark for its Overnight Rate is a rather intriguing indication. The U.S Fed is expected to raise by another 0.75% this November, but some financial houses are clearly beginning to believe the U.S central bank will then pause to see how the economic winds blow. Today the U.S GDP numbers are going to be released, tomorrow Canada will publish its Gross Domestic Product statistics. The question is if the Bank of Canada understands recessionary pressures are mounting stronger than expected.

Traders should monitor the GDP numbers from the U.S and Canada the Next Two Days

- If GDP numbers from both the U.S and Canada come in below expectations this might put the USD/CAD into a stronger bearish mode and ignite additional selling.

- If the 1.35550 to 1.35400 ratios begin to be challenged, it could mean a shift of behavioral sentiment has begun.

Speculators who have been waiting for the ‘great change’ in trend may be growing excited. There can be no promises made, but today and tomorrow will be important regarding economic data points for the U.S and Canada combined. If Gross Domestic Product numbers come in weaker than expected it would be a clear sign that the Bank of Canada didn’t raise 0.75% because they fear recessionary troubles, even though inflation remains rather stubborn.

Selling the USD/CAD when it touches perceived technical resistance today may prove to be an intriguing wager for traders with an eye on lower values. However, speculators must remain cautious and not be overly ambitious. We are not out of the woods yet and clarity has proven difficult to maintain.

Canadian Dollar Short Term Outlook:

Current Resistance: 1.35950

Current Support: 1.35550

High Target: 1.36850

Low Target: 1.34890

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.