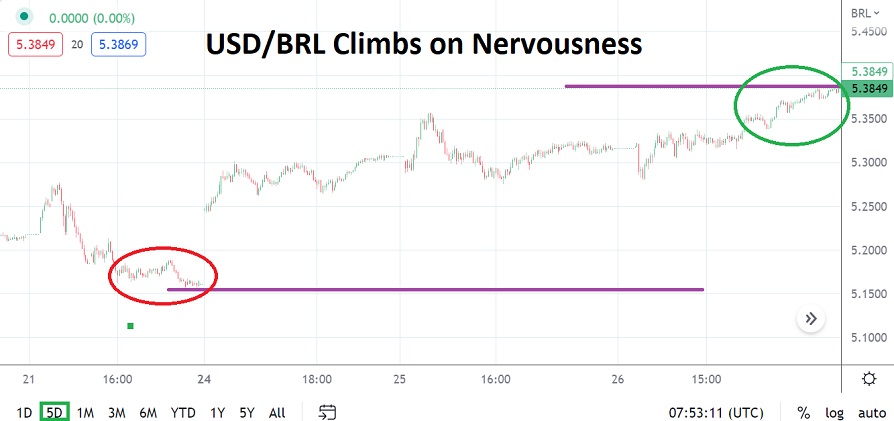

After trading to lows of nearly 5.1500 on Friday of last week as polls in Brazil suggested a closer than anticipated election result for President, the USD/BRL has now performed a strong reversal higher. As trading gets set to open today the USD/BRL is near the 1.3850 ratio and speculators should count on a gap being demonstrated which will highlight the volatility to come near-term.

The next three days of trading in the USD/BRL may prove to be fast and dangerous. The upwards velocity of the USD/BRL displayed since Wednesday when the Forex pair was near the 5.2800 vicinity suggests financial houses are nervous about the outcome and likely fear the election of a left leaning government which is not considered pro-business.

The USD/BRL is going against the Prevailing Trend

Even as the USD has gotten weaker against many currencies it is paired against in Forex, the USD/BRL has managed to turn in a trend which goes against the grain, this as the Brazilian Real weakens. Traders should anticipate further nervousness with the USD/BRL in the coming days, and if they choose to take positions it should be done with solid risk management in place.

Today and tomorrow are likely to experience plenty of price action. If a trader wants to run the risk of carrying a trade into the weekend, they should be extremely cautious, and have a firm stomach to handle the amount of nervousness that will be produced as Sunday’s vote is counted and the results are delivered early next week.

- If the USD/BRL opens higher and with a solid gap today it may signal highs seen in early October will be replicated.

- If the USD/BRL sustains value above the 5.4000 mark it will be a bullish indicator that trading houses are preparing for a victory by Lula who is likely not favored by many financial institutions.

Risk Taking and Speculative Opportunity Exists for the Brave in the USD/BRL

If a trader suspects that a new President will be elected this coming Sunday in Brazil, they may want to buy the USD/BRL and see exactly where perceived fear of a new political administration will take the currency pair. Traders should be extremely cautious and use limited leverage. Volatility is certain to be seen near-term and price action could be fast.

A move across the 5.4000 mark and challenge to highs seen in early October would not be a surprise. However, whipsaw like reversals could also be exhibited as nervous conditions throttle the USD/BRL in the coming days.

Brazilian Real Short-Term Outlook:

Current Resistance: 5.3990

Current Support: 5.3745

High Target: 5.4910

Low Target: 5.3330

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.