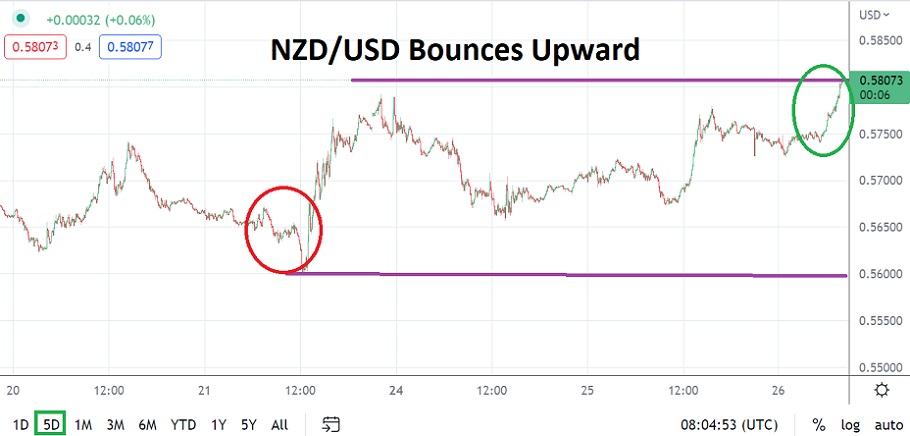

The NZD/USD is trading within sight of the 0.58000 ratio this morning. On Monday of this week the NZD/USD was traversing below near 0.56600, yesterday’s low was within the 0.56700 vicinity. The ability of the NZD/USD to climb higher since touching a low of approximately 0.55100 on the 13th of October looks interesting technically.

Technical Lows may have provided an upwards Kick for the NZD/USD, Fundamentals will be the Fuel

Two days of rather lackluster economic data reports from the U.S have helped the NZD/USD grow its near-term bullish trend. The NZD/USD has been within the grip of a long-term bearish trend, but after testing lows a bit more than ten days ago, there are signs behavioral sentiment might be shifting. Proclaiming the end of the bearish trajectory could prove to be very dangerous and wrong, but now may be the time for speculators to start thinking about the potential of higher values.

A move above the 0.58000 in the NZD/USD could Attract more Bulls

The NZD/USD has a long track record of providing worthwhile speculative trends to wager. If the recessionary outlook holds in the U.S and there is reason to suspect it will, the U.S Federal Reserve may be forced to halt their hawkish interest rate policy sooner rather than later. Yes, the U.S central bank has all but promised another hike in November, but if data continues to show a recession is underway the Fed may have to pause and consider its next moves very carefully.

- If the NZD/USD can sustain price action above the 0.58000 ratio and challenge resistance not seen since late September, speculators may believe additional room to the upside exists for the currency pair.

- The NZD/USD can move fast and the belief that the Forex pair has been oversold the past couple of months could trigger speculative buying.

Global markets remain nervous and fragile within equity indices, but the belief the U.S Fed will begin to turn less aggressive could help the outlook for the NZD/USD. Speculators need to remain realistic and not be overly ambitious, there is a definite risk a reversal lower could develop quickly. However, traders who have the desire to make short term bets on bullish moves with the NZD/USD cannot be blamed. Looking for resistance near the 0.58150 to 0.58500 and perhaps even above in the short term may prove to be a worthwhile buying position.

NZD/USD Short-Term Outlook:

Current Resistance: 0.58260

Current Support: 0.57710

High Target: 0.59110

Low Target: 0.57150

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.