- Spot natural gas prices (CFDS ON NATURAL GAS) declined during the recent trading at the intraday levels.

- It recorded slight daily losses until the moment of writing this report, falling by 0.09% to settle at the price of $6.456 per million British thermal units.

- This happened after declining by 1.10% during yesterday’s trading in the session was characterized by volatility.

US natural gas futures fell on Monday in volatile trading, as expectations of rising gas demand over the next two weeks outpaced record production levels.

US gas futures lag global prices, because the US is the world's largest producer of the commodity with all the fuel it needs for domestic use. Capacity constraints and outages prevent the Freeport LNG export plant in Texas which is the second largest US natural gas plant. The state liquefied the export of more liquefied natural gas.

The average amount of gas flowing into US LNG export plants has fallen to 10.8 billion cubic feet per day so far in October from 11.5 billion cubic feet per day in September. That compares with a monthly record of 12.9 billion cubic feet in March. The seven major export plants in the United States can convert about 13.8 billion cubic feet of gas into liquefied natural gas.

US futures are up about 83 percent so far this year, as higher global gas prices fueled demand for US exports due to supply disruptions and sanctions linked to Russia's invasion of Ukraine on February 24.

Meanwhile, the average Russian gas exports via the three main lines to Germany - Nord Stream 1 (Russia - Germany), Yamal (Russia - Belarus - Poland - Germany) and the Russia - Ukraine - Slovakia - Czech Republic - Germany - 1.3 billion cubic feet per day only. So far in October the same as September but much less than 9.2 billion cubic feet per day in October of 2021.

Natural Gas Technical Analysis

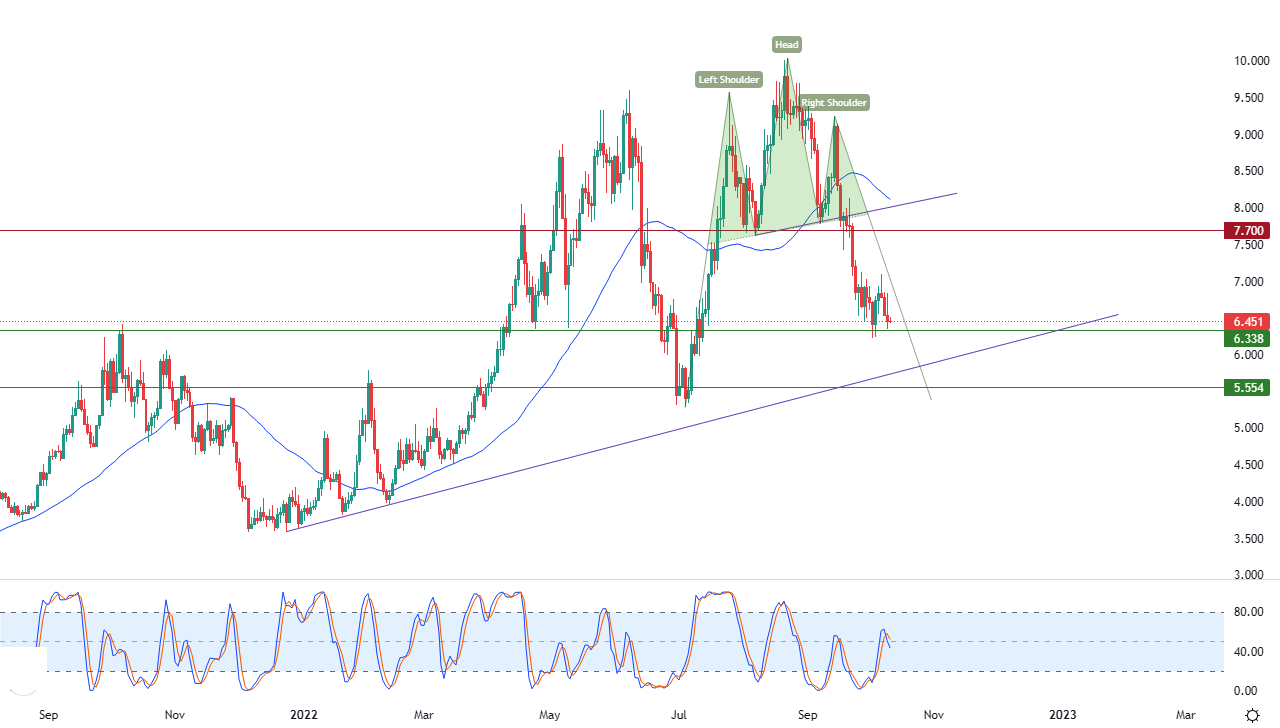

Technically, the price reached its recent trading to rely on the pivotal 6.338 support level, with pressure from continuing its trades below the simple moving average for the previous 50 days and affected by a negative technical structure. This structure was formed in the short term, which is the head and shoulders pattern, as shown in the attached chart for a period (daily). In addition to the above, we notice the start of negative signals on the RSI indicators again.

Therefore, our expectations indicate more decline for natural gas during its upcoming trading, especially in case it breaks the 6.338 support, to target the 5.554 support level after that.

Ready to trade Natural Gas in Forex? Here are some excellent commodity trading platforms to choose from.