- The continued strength of the US dollar contributed to the decline in the price of XAU/USD (gold) towards the support level of $ 1622 an ounce, its lowest level in three weeks.

- This happened as speculation that the US Federal Reserve will continue to tighten monetary policy strongly goes on, as well as the idea that it may lead to a recession, which prompted investors again to Searching for a haven in the US dollar.

- The renewed strength of the dollar has now seen bullion prices fall more than 20% since the March peak. The non-rising metal, which usually has a negative correlation with the dollar and interest rates, has come under pressure from the strength of the US currency.

Yesterday, Minneapolis Fed President Neil Kashkari said the US central bank cannot pause its tightening campaign once the benchmark interest rate reaches 4.5% to 4.75% if “core” inflation is still accelerating. This led to a higher US dollar and higher bond yields. Inflation problems extend beyond the US, as indicated on Wednesday by CPI measures from Canada and the UK, both of which came in higher than expected.

On another note. Wall Street stumbled before the opening bell yesterday after two days of big gains as brilliant quarterly performances from major US companies fueled markets with a dose of optimism. Wall Street's S&P 500 futures slipped 0.4% after the market index rose 1.1% on Tuesday on strong results from investment bank Goldman Sachs and military contractor Lockheed Martin and others. Dow Jones Industrial Average futures lost 0.3%.

The Dow is up more than 6% this week, but is down 16% this year. The S&P has jumped nearly 4% this week, but is down 22% for 2022. Yesterday, Procter & Gamble reported a strong first fiscal quarter, but the world's largest consumer products maker lowered its forecast for 2023, saying it expects to post its first annual decline. in its sales since 2017. It cited a rising US dollar. Earnings reports this week offset concern that repeated interest rate increases by US, European and Asian central banks to control multi-decade inflation could push the global economy into recession.

That sent US stocks into a bear market, or a more than 20% drop by the S&P 500 from its January high.

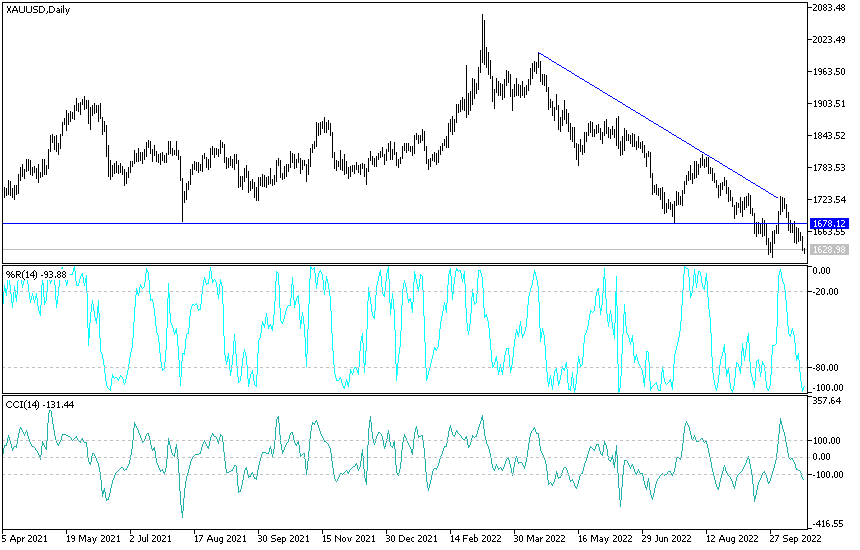

XAU/USD Gold Price Forecast:

The bearish trend for the XAU/USD gold price is getting stronger and stability below the support level of $1625 an ounce will support the stronger bearish expectations, which may bring the impetus to test the psychological support level of $1600 an ounce, which will be a distinct buying opportunity for gold.

The price of gold will continue to react to the strength of the US dollar and the extent to which investors take risks or not. I still prefer buying gold from every bearish level. On the other hand, the psychological resistance of 1700 dollars an ounce will remain the only way to change the direction of the gold price to the upside.

Ready to trade our Gold trading prediction? We’ve made a list of the best Gold trading platforms worth trading with.