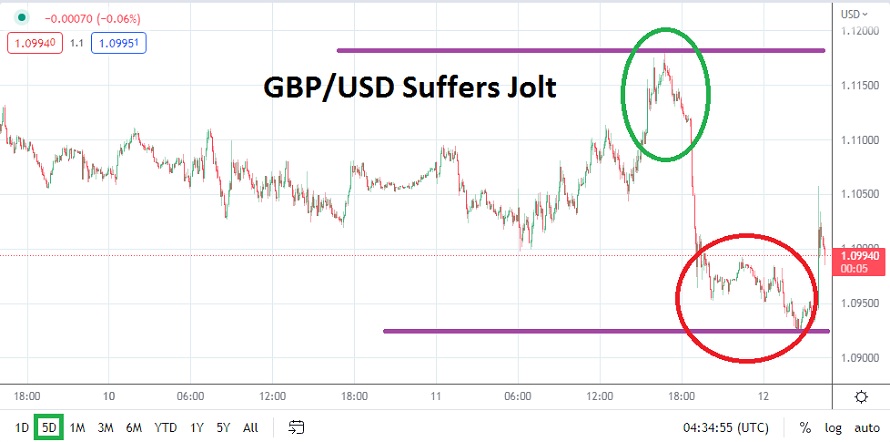

The GBP/USD slammed lower in late night trading as a comment from BoE Governor Andrew Bailey poured gasoline into already fragile global markets.

As of this writing the GBP/USD is near the 1.09860 mark and traders are urged to compare this quote to the actual market as they read. Lightning bolts are occurring in the GBP/USD because of a lack of credibility which is perceived by global financial houses as they react to pronouncements from the U.K government. The latest massive news to hit the media was a threat that the Bank of England would end its intervention into the U.K bond market in three days. Early in the evening yesterday the GBP/USD was near the 1.11775 before tumbling lower.

Let’s simplify this, because it is complex and frankly many institutional trading houses are unclear on what the implications are moving forward. The U.K government knows that British pension funds face a short fall of funds; they also know that a weaker GBP/USD is a major problem, and let’s add that higher interest rates and potentially more to come are causing problems too. If the Bank of England actually reduces its intervention this week, it could mean U.K pension funds who have problems with their cash balances could have to start selling equities to have enough money.

Complex Problems are Causing Massive Gyrations in the GBP/USD

The above is a complex puzzle and there is a chance facts could change on the ground very quickly, the U.K government in the last week of September made a change to fiscal policy and in a matter of days were forced to change their plans. Central banks have a habit of working in the shadows; they are not fond of letting people know every move they will make. However, if the BoE refuses to continue ‘protecting’ the U.K bond market with intervention, disruptions could occur.

- More extreme volatility in the GBP/USD will likely occur. Very fast conditions and almost ‘third world’ like price action in the GBP/USD and U.K bonds largely referred to as ‘Gilts’ may flourish near term.

- Any speculator wanting to participate with the GBP/USD is cautioned. It might be better to sit on the sideline and watch the GBP/USD the next few days.

Speculators who ‘Need’ to Participate in the GBP/USD need to be Careful

The dynamics of the GBP/USD are likely to be rather impressive in the near term. In four weeks of trading the U.K government has caused fireworks. If the GBP/USD drops below the 1.09100 level this could signal another leg down. However, reversals are bound to be very fast and traders should treat the GBP/USD as a dangerous Forex pair over the coming days. Opportunities abound for wagers, but GBP/USD currency pair bets could prove extremely expensive.

Having ripped to ‘record’ lows between the 26th and 28th of September, traders should remain cautious and realistic about the ‘value’ they can capture in a GBP/USD trade. Price entry orders are suggested to make sure ‘fills’ meet expectations, but again reversals and sharp moves should be expected. Be careful with the GBP/USD in the near term.

GBP/USD Short Term Outlook:

Current Resistance: 1.10100

Current Support: 1.09650

High Target: 1.10900

Low Target: 1.09100

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.