Today's recommendation on the lira against the dollar

- Risk 0.50%.

- None of yesterday's buy or sell orders were activated

Best entry points buy

Entering a long position with a pending order from levels of 18.30

- Set a stop-loss point to close below the 18.15 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the strong resistance levels at 18.49.

Best selling entry points

- Entering a short position with a pending order from levels of 18.50

- The best points for setting stop-loss are closing the highest levels of 18.55.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 70 pips and leave the rest of the contracts until the support levels 17.85

Analysis of the Turkish lira

The Turkish currency recorded its lowest level ever against the US dollar after the strong dollar rose yesterday against the major currencies and emerging market currencies. This is after the US Federal Reserve’s decision to raise interest rates by 75 basis points during yesterday’s meeting, to record US interest rates at their highest level since 2008. The Fed members' comments indicate continued monetary tightening, which could give the dollar some strength against the decline in other currencies. On the other hand, analysts expect the interest rate to be fixed in Turkey in the best case, as the Turkish Central Bank adheres to a monetary stimulus policy, ignoring inflation, which rose to 80 percent. It is noteworthy that the Turkish currency has lost about 27 percent of its value against the US dollar this year, compared to a loss of 44 percent last year.

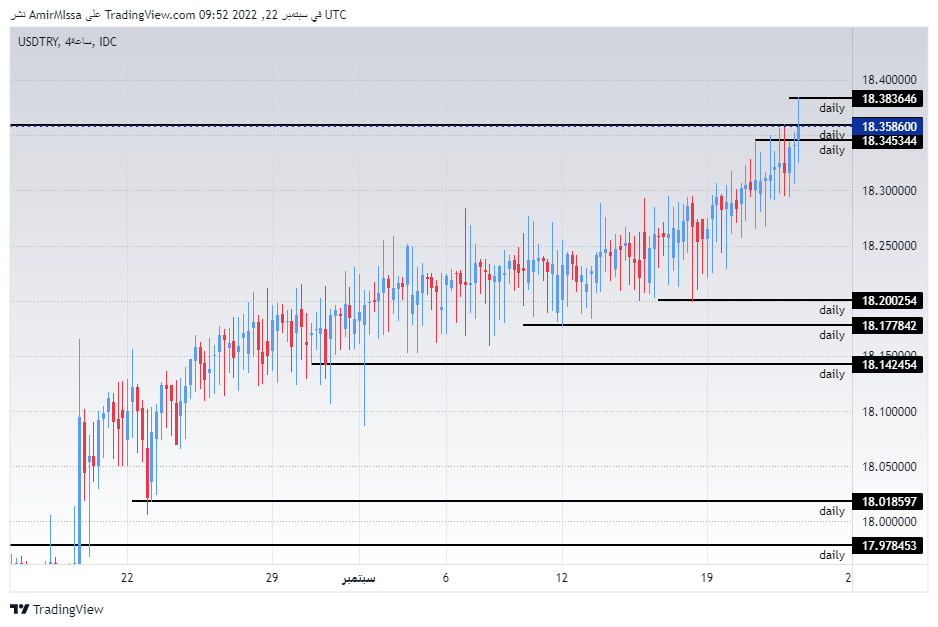

- The Turkish lira continued to decline against the dollar, to record a new high that exceeded the peak recorded earlier this week.

- The pair recorded record levels at 18.38 levels, before the pair returned to trading in a narrow range of movement shown on the chart.

- The pair broke the upper boundary of the ascending channel on the four-hour time frame.

- The pair is still trading above the 50, 100 and 200 moving averages on the daily time frame, as well as on the four time frame, where the pair maintained the bullish trend.

The pair is also trading the highest levels of support, which are concentrated at levels of 18.30 and 18.25, respectively. On the other hand, the lira is trading below the resistance levels at 18.49. Any drop for the pair represents an opportunity to buy back again with the aim of reaching the previous high recorded during the past year. Please adhere to the numbers in the recommendation with the need to maintain capital management.

Ready to trade our free Forex signals? We’ve shortlisted the best Forex trading brokers in the industry for you.