Despite the recent profit-taking sale of the USD/JPY currency pair, it is seen as healthy and normal after the currency pair's gains to its highest in 24 years. The general trend is still bullish as long as it is stable above the psychological resistance 140.00. The US dollar is still maintaining record earnings factors and may remain so for the remainder of 2022. The recent selling operations pushed the dollar-yen pair towards the support level 142.10 after its strong gains towards the resistance level 145.00.

- Continuing factors support the strength of the US dollar against the rest of the other major currencies.

- The annual loss of the Japanese yen reached extreme levels at times last week, prompting growing protests from the Japanese Ministry of Finance, but there is a risk that the market speculators driving this are inadvertently engaging in Russian roulette.

- The Japanese yen outperformed the major currencies on Friday in a market that saw US dollar exchange rates fall broadly and risk assets rose almost across the board.

- There was no indication that this price action was anything more than profit-taking before the holiday weekend.

Commenting on this, Greg Anderson, FX Analyst at BMO Capital Markets says, “We can't point to a catalyst in the evening news for this risk mitigation, but we think the markets went one-way earlier in the week to the point that they were fairly primed. What for 'mood swings' as traders say, 'They stopped positions for the weekend'. “Before today, the (sixth) verbal intervention has largely faded away over the past few months, so it is likely to have some impact on the forex market perhaps during the Bank of Japan meeting on September 22,” the analyst added at the end of last week.

Meanwhile, a lot of market commentary remained firmly bearish while the Ministry of Finance became more attentive to its currency. BMO's Anderson said on Friday, “The big round of the sixth level we saw when USD/JPY broke the 125 resistance and got close to 130 and wasn't able to seriously alter market forces, and we still think that is the case. We still think it makes sense to buy dips in USDJPY and the 141.00 support level looks like a really good deal, if it can be got.”

Many in the market argued that the low interest rates and bond yields chaired by the Bank of Japan (BoJ) were reason enough for the depreciation of the Japanese yen, given the high import prices for energy and the tightening interest rate of the Federal Reserve's (Fed) policies.

However, some Japanese officials say the recent declines in the yen have outpaced what can be justified by economic and financial fundamentals, while many have become increasingly vocal in warning that official intervention to support the currency is becoming increasingly likely. On Friday, Bank of Japan Governor Haruhiko Kuroda was reported to have described last week's moves as "very surprising" while Finance Minister Shunichi Suzuki said before him "necessary action will be taken if the yen continues to decline," which is important because the Ministry of Finance is the decision maker - when it is about intervention. The Japanese Ministry of Finance maintains the world's second largest foreign exchange reserve fund which amounted to about $1.29 trillion at the end of August, down $30.96 billion from the end of July, but there is a widely held view in and around the market that it may not be enough to support the Japanese yen.

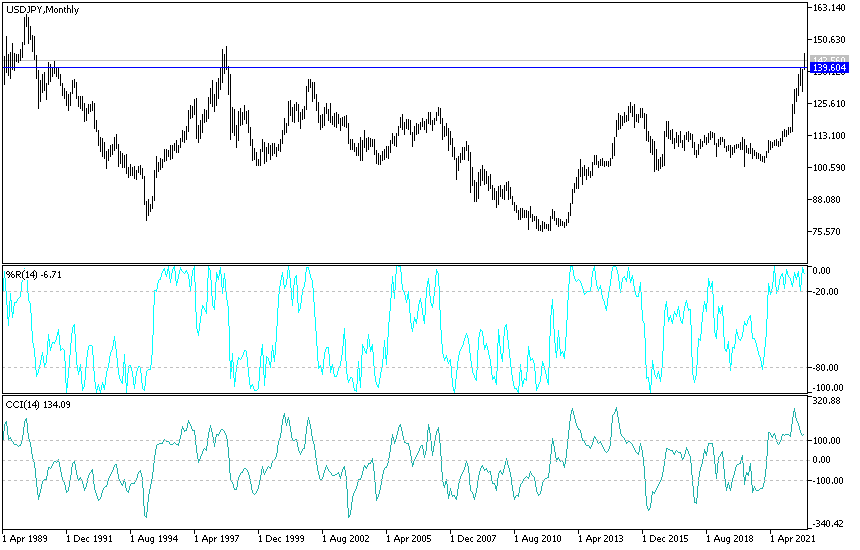

USD/JPY Technical Analysis:

In the near term and according to the performance of the hourly chart, it appears that the USD/JPY is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will target short-term profits at around the support 142.09 or lower at the support 141.24. On the other hand, the bulls will look to bounce around 143.32 or higher at the 144.13 resistance.

In the long term and according to the performance on the daily chart, it appears that the USD/JPY is trading within the formation of a sharp bullish channel. This indicates a strong long-term bullish momentum in the market sentiment. Therefore, the bulls will look to extend the current uptrend towards 144.79 or higher to 147.09 resistance. On the other hand, bears will look to pounce on profits at around the 139.87 support or lower at the 137.26 support.

Ready to trade our Forex trading predictions? Here are some excellent Forex brokers to choose from.