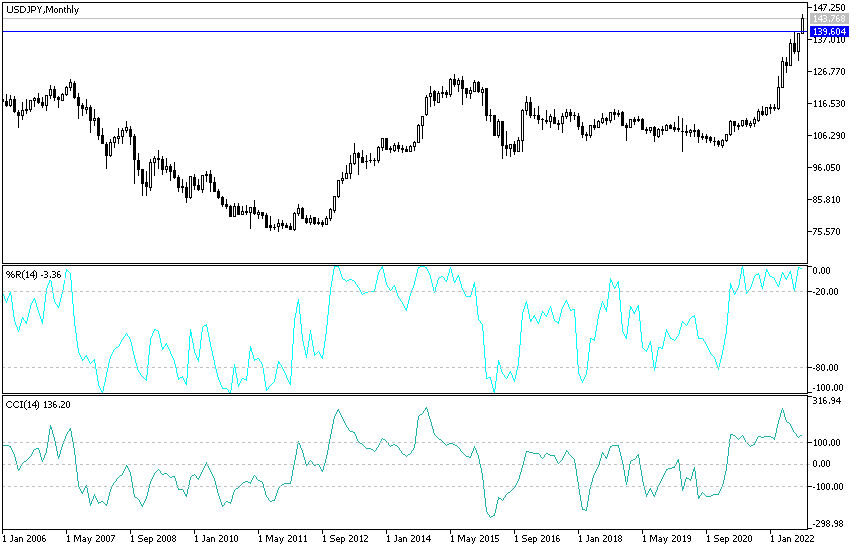

The continued strength of the US dollar, supported by the expectations of a strong US interest rate hike in the coming months was enough to push the USD/JPY currency pair to move towards the 145.00 resistance level, its highest in 24 years. This is a sharp and continuous upward move for several trading sessions. It is moving all technical indicators on all frames to overbought levels, and accordingly, the dollar-yen currency pair may be exposed to profit-taking operations at any time. The dollar-yen pair is stabilizing around the level of 143.65 at the time of writing the analysis.

Worst Year for Yen

The Japanese yen has fallen to a level that is on track for its worst year ever, prompting the strongest warnings yet from top Japanese government officials aiming to halt the decline. In his strongest comments yet, Chief Cabinet Secretary Hirokazu Matsuno said he was concerned about the recent rapid unilateral moves and that Japan would need to take action if they continued.

“The government will continue to monitor the movements of the forex market with a high sense of urgency and take the necessary responses if this type of movement continues,” the chief country spokesperson said. Finance Minister Shunichi Suzuki said he has been watching the yen's weakness with great interest, Kyodo News reported separately. Despite the barrage of warnings, the comments proved insufficient to contain the continued slide of the yen.

Commenting on this, Teppei Ino, Head of Global Markets Research at MUFG Bank Ltd said, "While the tone of verbal intervention has become a little stronger, market sensitivity may decline because the focus now is whether there will be actual intervention." The verbal intervention or the actual tripartite meeting of the Bank of Japan, the Ministry of Finance and the Financial Services Authority is most important to the markets.”

The Japanese currency has fallen 20% this year, surpassing its worst annual decline in 1979. A renewed sell-off in Treasuries this month has widened the yield gap between the US and Japan, sending the dollar up and pushing the yen to a 24-year low.

The Bloomberg Spot Dollar Index has extended to a record high for the gauge.

The rise of the dollar-yen above the 144 level for the first time since 1998 will increase pressure on Bank of Japan Governor Haruhiko Kuroda's challenge to the global shift towards higher interest rates, and the strength of Prime Minister Fumio Kishida's support for his position. Accordingly, Mari Iwashita, chief market economist at Daiwa Securities, said: “The Ministry of Finance and the Bank of Japan probably think that the current stage is clearly the strength of the dollar, not the yen issue.” The Bank of Japan needs to adjust its policy.”

In June, Japanese officials said they would take action if needed, without specifying what it would be, after a trilateral meeting held between the Ministry of Finance, the central bank and the Financial Services Agency. The last time Japan intervened to prop up the currency was in 1998, around the same time that most of Asia was experiencing a regional financial crisis. For his part, Kuroda has repeatedly said that foreign exchange policy is the prerogative of the Ministry of Finance, not the Bank of Japan, while standing up for its position of maintaining low interest rates to support the economy and generate a more stable form of inflation. He insisted that any policy adjustment to alter the currency tide would be largely useless anyway.

In the bond market on Wednesday, the Bank of Japan said it will boost scheduled debt purchases as increased Treasury sales also weigh on yields. The move came as Japan's benchmark 10-year yield approached the upper end of 0.25% of the Bank of Japan's allowed trading range. In the options market, bets are increasing on further yen weakness. The one-year risk reversals on the dollar against the yen - a measure of the currency pair's expected direction during this time frame - reached their highest levels since 2015, according to data compiled by Bloomberg.

Dollar yen forecast today:

- The general trend of the USD/JPY currency pair is still bullish.

- The currency pair testing the resistance 145.00 has technical indicators moving towards strong overbought levels.

- This may involve activating profit-taking at any time.

- If that happens, the trend may remain within a range.

The rise, as the US dollar is still strong, with expectations of US interest rate hikes on a hawkish path, which contrasts with the situation in Japan. The closest support levels for the currency pair are currently 142.90 and 141.00, and in general, stability above 140.00 will continue to support the bulls' control of the trend.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.