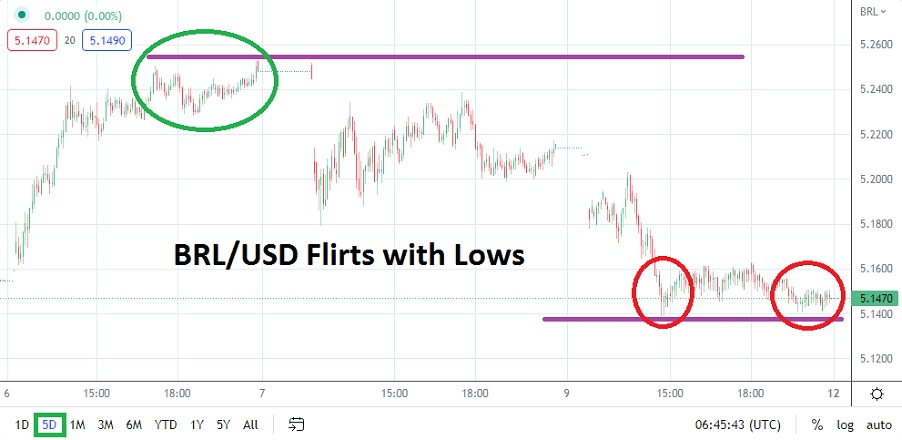

The USD/BRL finished trading last week near the price of 5.1470, which is a short term lower price range. On the 1st and 6th of September the USD/BRL currency pair was trading near the 5.2500 realm. Last week’s trading in the USD/BRL should be viewed suspiciously by speculators because Brazil celebrated its Independence Day holiday on the 7th which created light trading volumes.

While the USD/BRL certainly moved lower on the 8th and 9th of September, traders may believe today’s price action may hold important behavioral sentiment clues. Yes, in late August the USD/BRL moved toward the 5.0000 realm which had last been seen in the middle of June, but some traders may remain skeptical of the bearish trend. On the 21st of July the USD/BRL was trading near the 5.5200 juncture and has definitely powered lower.

However, Lower Price Range may be viewed as Buying Opportunity by some Traders

The USD/BRL does not trade in a vacuum and the move downwards in the USD/BRL should raise eyebrows. Technically if the USD/BRL continues to experience selling and the 5.1350 mark is flirted with this could potentially trigger more short term selling. The low for the USD/BRL in September was essentially the 5.1350 mark seen on Friday. The question is if the USD/BRL can break through this support barrier in a dynamic manner and some may not believe in this capability.

- The opening in the USD/BRL should be watched carefully. A lower move in the Forex pair could spark more short term selling with an eye on the 5.1100 ratio as a target.

- A spark higher early could signal the USD/BRL was believed oversold the past couple of days, when light trading volumes were experienced.

Coming Presidential Election in Early October may start to create a Chill for the USD/BRL

Technical traders may not want to consider the upcoming Brazilian Presidential election in early October as a concern, but this fact could still prove important. The notion the election for President of Brazil will be occurring soon may send a shiver into the thinking of financial houses who may be worried about the potential of a change in government within Brazil. It is correct that a second election will likely be needed at the end of October, but some financial institutions may be thinking ahead.

In addition to the domestic electoral concerns in Brazil is the concern the U.S Fed will hike their interest rate next week on the 21st of September. While the USD/BRL trades near important support, bullish traders may be inclined to be buyers near term if current price levels hold early today. Speculators who seek buying wagers of the USD/BRL cannot be blamed if support levels hold near the 5.1350 mark today.

Brazilian Real Short Term Outlook:

Current Resistance: 5.1560

Current Support: 5.1390

High Target: 5.1985

Low Target: 5.1080

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.

Ready to trade our Forex analysis today? We’ve made a list of the best brokers to trade Forex worth using.