Spot natural gas prices (CFDS ON NATURAL GAS) advanced in the recent trading at the intraday levels, to achieve slight daily gains until the moment of writing this report, by 1.02%. It settled at the price of $8.152 per million British thermal units, after rising during trading on Friday and for the second day. Consecutively, by 0.95%, and the price recorded sharp losses in last week's trading by -9.75%, this is the largest weekly loss for the contract since late June, and the first time it recorded consecutive weekly losses since early July.

Increase in Gas Futures

US natural gas futures rose 1% on Friday, supported by forecasts of warmer weather and increased gas demand from mid to late September. In the western United States, a tropical storm approaching southern California threatened to bring strong winds that could spark wildfires and torrential rain that could trigger flash floods, but that is likely to ease a 10-day heat wave.

The increase in gas futures came despite the ongoing outage at the Freeport liquefied natural gas (LNG) export plant in Texas, which left more gas in the US for utilities to pump into storage for the coming winter. The Freeport terminal was the second largest LNG export plant in the United States, consuming about 2 billion cubic feet per day of gas before shutting down on June 8. Freeport expects the facility to return to at least partial service in early to mid-November.

Meanwhile, natural gas flows from Russia to Europe along the main lines were flat on Monday morning, while the Nord Stream 1 pipeline remained shut down. It was stopped by Russia, which extends under the Baltic Sea to Germany on August 31 for what was supposed to be three days of maintenance.

Russia's Gazprom said on Monday it will ship 42.4 million cubic meters of natural gas to Europe via Ukraine, unchanged from yesterday.

Natural Gas Technical Outlook

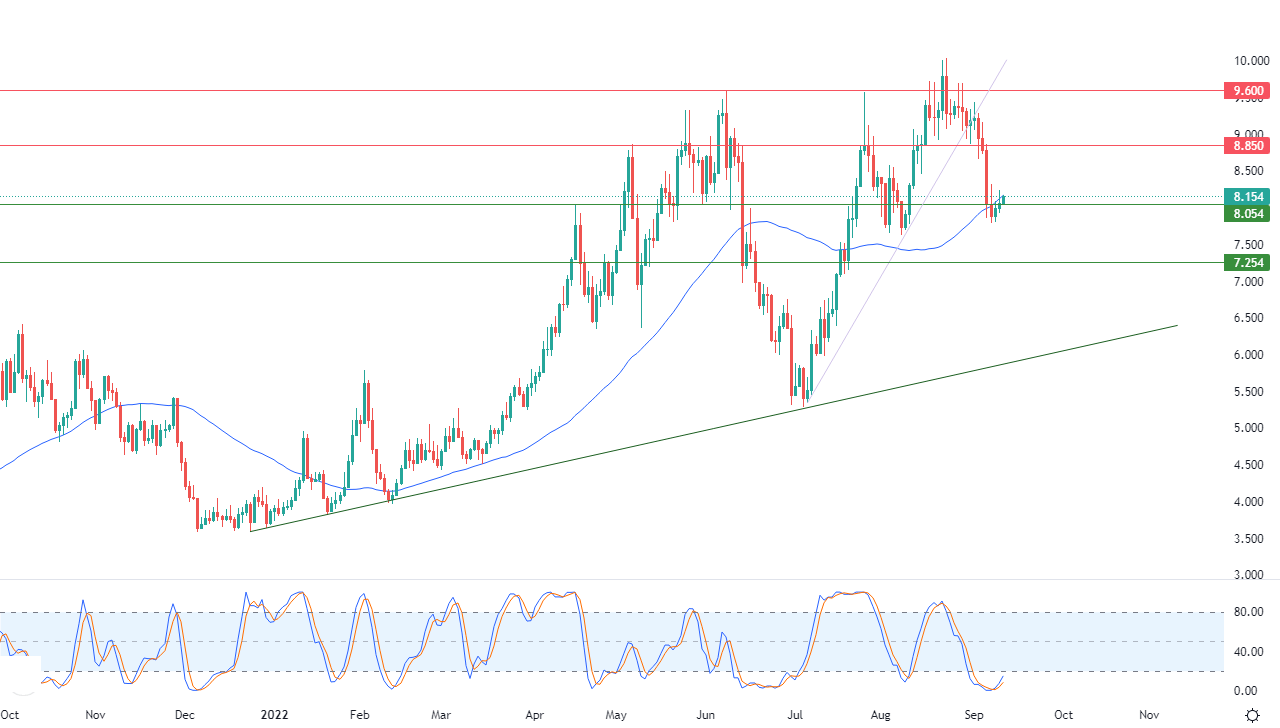

- The price is struggling in its recent trading to get rid of the negative pressure of the simple moving average for the previous 50 day.

- This is amid the stability of the important support level 8.00, and in light of the dominance of the main bullish trend in the medium term along a slope line.

- This is shown in the attached chart for a (daily) period.

- We notice the start of the influx of positive signals on the relative strength indicators, after forming a positive divergence, as it reached oversold areas, exaggeratedly compared to the price movement.

Therefore, our expectations suggest that natural gas will rise during its upcoming trading, but provided that the main support level 8.00 remains intact, to target the first resistance levels at 8.85.

Ready to trade our FX Natural Gas analysis today? We’ve shortlisted the best commodity brokers in the industry for you.