The renewed pullback in global markets has put more pressure on the British Pound. and all indications are that more losses are likely, which could lead to a retest of recent lows. The reason for the recent decline in global markets was the release of better-than-expected data from the US, which in turn led investors to bet that the Federal Reserve may have to accelerate the pace of US interest rate hikes.

GBP/USD Rebounded Strongly

Expectations of higher interest rates weighed on stock markets and boosted the dollar, which in turn put pressure on sensitive currencies, such as the British pound. In the case of the GBP/USD pair, it collapsed to the 1.0352 support level, its lowest ever. The GBP/USD pair rebounded strongly to the resistance level of 1.0915 after the Bank of England took emergency action on Wednesday to stabilize Britain's financial markets. It averted a crisis in the general economy after the government scared investors with a program of unfunded tax cuts, which led to a decline of the British pound and the rising cost of government debt.

The British central bank warned that a collapse in confidence in the economy posed a "material risk to the UK's financial stability", while the International Monetary Fund took the rare step of urging a member of the Group of Seven advanced economies to abandon its plan to cut taxes and raise borrowing to cover the cost.

As is well known, the British Pound is closely related to risk and tends to fall when global markets decline. In this regard, Marius Hadjikiriakos, Senior Investment Analyst at XM.com says, “Higher interest rates are primarily an attractiveness for the financial markets. When interest rates rise, riskier assets come under selling pressure as investors roll back their risk-taking behavior in favor of more conservative play. And it doesn’t make sense to gamble on some risky trade and the investor can suddenly earn a decent and risk-free return.”

The decline in sterling and other risk-sensitive assets triggered new orders for durable goods data, which showed a 0.2% decline in August, but this was better than the consensus forecast for a 0.3% decline. The Fed will be more encouraged to raise US interest rates as US new home sales rose 28.8% in August to 685K, despite already raising the Fed funds rate to 3-3.25%.

Beating the influx of better-than-expected data, the Consumer Confidence Index rose 4.2% in September, marking the second consecutive rise and easily outstripping the expected 1.3% gain. As the US raises interest rates, the cost of financing is rising globally, putting pressure on the global economy towards a slowdown.

A rising dollar provides additional headwinds, making it difficult for many countries and companies to repay debts pooled in dollars. But a strong dollar is also inflation: Think of the additional inflationary pressures that Europe and the UK face as their currencies depreciate against the dollar. The cost of imported goods and services in local currency is rising, which is particularly harmful in an energy crisis: the UK and EU are net energy importers. In short, the US is exporting its inflation at the expense of the rest of the world. These challenging market conditions come at a time when the UK is desperately trying to persuade investors to invest in its public debt to fund government spending. The influx of capital this creates is at the same time crucial to supporting the value of the pound.

Difficult Outlook for GBP Ahead

As investors face increasingly challenging global conditions, it is becoming increasingly difficult to obtain inflows into sterling assets. This is before we consider investors' concerns about the new government's fiscal policy: spending commitments and tax cuts to be financed through debt have prompted international investors to demand greater compensation for holding UK debt. This is evidenced by rising bond yields on both the short and long-term time frames, which in turn raise mortgage rates and promise a sharp slowdown in the UK housing market over the coming months. The outlook for the British pound remains tough and further losses are likely.

Sterling dollar forecast today:

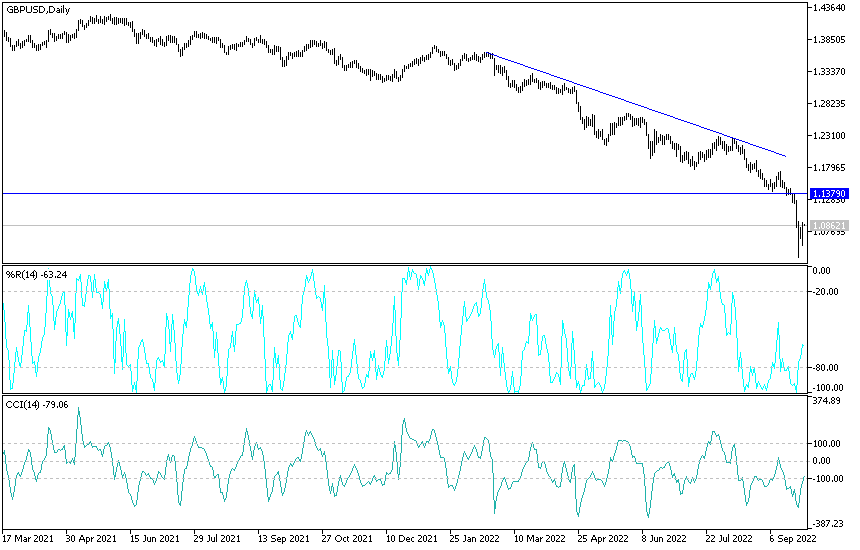

- Despite the attempts to rebound higher for the GBP/USD pair, the general trend is still bearish.

- The pair needs to first break the resistance 1.1380 to have a stronger rebound chance.

- On the other hand, breaking the 1.0700 support again will bring the bears back to a strong starting point to test new record levels of support.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.