- The GBP/USD fell down to the 1.1498 support level, its lowest since the year 2020.

- Forex traders are currently counting this week on the policy of the new British Prime Minister to save the pound from a new sharp bearish fate.

- HSBC's analysis shows that the UK economy is unlikely to control a currency that could rise over a multi-year timeline unless it can shake off its addiction to imports. This leaves the pound dependent on the money of outside investors.

The UK is a net importer, which means it spends more than it earns, which is a "core" economic problem for the pound. Both the Eurozone and the UK face challenging cyclical dynamics, including weak growth, high inflation, and restrictive monetary policy.

GBP/USD Fundamental Analysis

According to the fundamental analysis, the GBP/USD currency pair is being traded influenced by the results of the US economic data. The US non-farm payroll for August outperformed the estimated 300,000 jobs by 315k. On the other hand, the country's unemployment rate for the month rose from 3.5% to 3.7%, the highest level since February. Analysts had expected the unemployment rate to remain unchanged from July. Elsewhere, average hourly earnings grew 5.2% compared to the same month in 2021, thus missing the consensus estimate of 5.3%, while US factory orders for July missed expectations (monthly) at 0.2% with a -1% change.

From the UK, the S&P Global/CIPS Manufacturing PMI for August beat expectations at 46 with a reading of 47.3. Home prices nationwide for this month were better than expected on a monthly (monthly) and (annual) basis. Prior to that, BRC's store price index for July was reported to grow by 5.1% year-on-year, up from 4.4%, as reported in the previous update.

On another note, UK stocks have had a rough year. With recession looming and sterling falling, it's hard to see how things will improve anytime soon for a new prime minister on this front. Britain's average capital index - made up of companies that rely heavily on the local economy - has fallen 20% this year and is on track for its biggest annual decline in performance against the massive FTSE 100. Pessimism about the economy has begun, with the Bank of England saying the recession could extend into 2024.

UK consumer price inflation crossed double digits for the first time in 40 years in July, Goldman Sachs Group Inc. Later, it could reach 22% next year if natural gas prices remain high. Against this backdrop, the domestic index experienced its worst losing streak since the pandemic-induced crash in March 2020, while investors became more negative on British stocks. And 15% of global fund managers are reducing the weight of state stocks, up from 4% in July, according to a Bank of America Corp. survey in August.

Underpinning the weakness is the tumbling UK currency, with the pound trading near its lowest level since 1985. While that's a boon for the FTSE 100 heavyweight - a favorite of the surprise investor this year due to its exposure to energy and banks - it means local businesses face rising costs. In the same way, customers are dealing with a cost-of-living crisis. All of this adds up to a bleak economic picture for the new British prime minister. Liz Truss, the current Secretary of State, is the front-runner in the race, and many investors have criticized her proposed tax cuts as inflationary.

GBP/USD Forecast

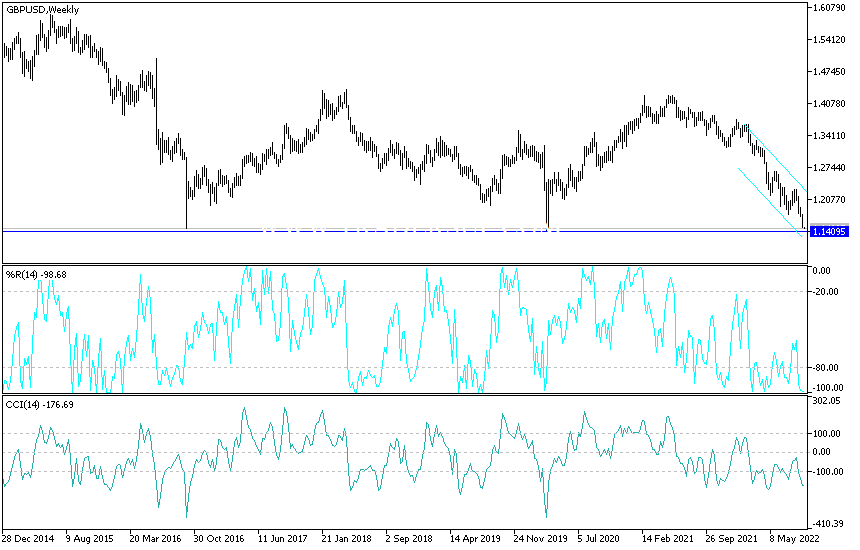

In the near term and according to the performance of the hourly chart, it appears that the GBP/USD currency pair is trading within a descending channel formation. This indicates a significant short-term bearish momentum in market sentiment. Therefore, the bears will look to ride the current trend towards 1.1477 or lower to 1.1434. On the other hand, the bulls will target potential recovery profits at around 1.1548 or higher at 1.1584.

In the long term and according to the performance on the daily chart, it appears that the GBP/USD is trading within the formation of a sharp descending channel. This indicates a strong long-term bearish momentum in the market sentiment. Therefore, the bears will target long-term profits at around 1.1363 or lower at 1.1189. On the other hand, the bulls - the bulls - will look to bounce around the 1.1675 resistance or higher at the 1.1856 resistance

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.