The GBP/USD has received a lot of bearish pressure recently as the Bank of England abandoned it regarding the future of its monetary tightening. The US dollar remained the strongest regarding the future of raising interest rates along with the strong positive performance of the US economy.

The GBP/USD pair fell to the cusp of the 1.1400 support, the lowest in years, and settled around the 1.1518 level at the time of writing the analysis. The British pound was better supported on the day it was reported that the new British government would provide a massive support package to families facing rising energy bills, but analysts remain wary of the currency's ability to rise.

Sterling was near the top of the currency leaders on September 6 on reports that new Prime Minister Liz Truss will effectively bring home energy bills to near current levels, a move economists could cut from peak domestic inflation.

Even some economists have suggested that peak inflation may already have passed if an increase in energy bills was introduced in October. “Inflation may have already peaked in July at 10.1% y/y,” says Fabrice Montagne, an economist at Barclays.

The current economic crisis in the UK is putting inflation at its heart.

It eliminates inflation and the problem dies along with it. Furthermore, a £40 billion package has reportedly been earmarked to support businesses. Taken together, these steps will significantly enhance the UK's economic growth prospects, not least through the morale boost that consumers and businesses will receive. After all, consumption and investment decisions are one of the main victims of the anxiety posed by the impending rise in energy bills.

Growth is important for the pound, says Paul Robson, forex analyst at NatWest Markets, and when the UK growth outlook improves, the pound may find its base against the dollar. It is clear that British assets are not viewed as attractive at current exchange rates. This means that the GBP risk is also heavily biased in favor of further declines, and sharp declines are likely. While the cyclical bottom of 1.1412 may see a pause, there is really no good reason to hold the decline at this level unless the growth outlook improves.”

The British pound was the second-best performing major currency following news of Truss' energy plan, which could cost the region between £100 billion-£130 billion. These tough times remain for those who buy FX, and the rally in sterling has not been entirely convincing, mainly because so far there are no concrete plans for investors to consider and because global factors still matter.

However, a trader in JP Morgan's Institutional Currency Sales office says the proposals will do enough to inquire about the "doom" story that has been hanging on the pound for much of the summer. He adds, “These plans will have a double-edged sword to boost growth and lower inflation expectations, and I think there is a window to ease the stagflation mentality before the final concerns about debt sustainability creep in, and it is time to be long a few pounds.”

The cost of the plans remains the most important point for investors. The UK is currently running a large budget deficit along with a trade deficit, which means it is vulnerable to deteriorating investor sentiment. Specifically, the UK needs foreign investors to stay ready to buy British government debt, which will increase as the government seeks to fund the rescue package.

Losing investor confidence will only raise the cost of servicing UK debt and risk a downward spiral for UK bonds and the British pound, making the task of supporting British households even more difficult. Forex analysts note that the British pound has recently failed to follow the rise in UK bond yields (the regular money the government pays investors out of the bonds it issues). The weak performance of the pound in a high interest rate environment could point to broader market concerns about long-term fundamentals in the UK.

Sterling dollar forecast today:

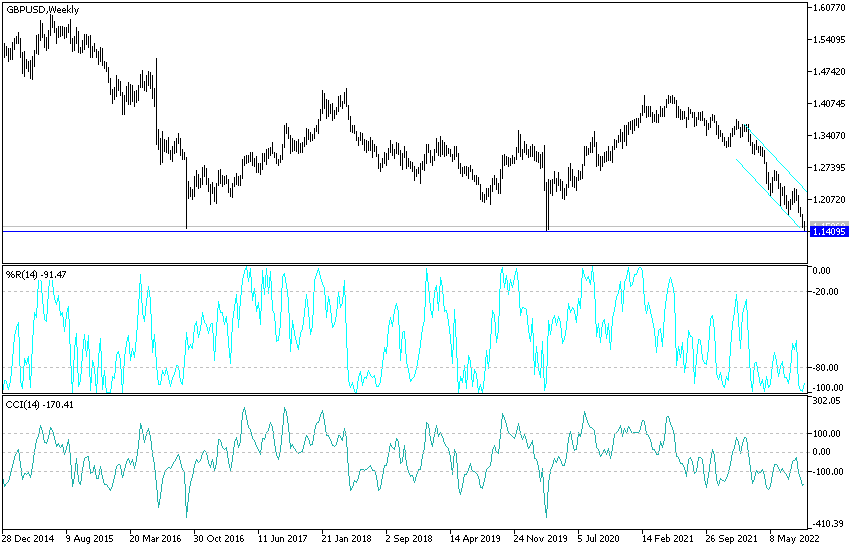

- The general trend of the GBP/USD pair is still bearish.

- There will be no chance for the currency pair to breach the current trend without testing the 1.2000 resistance so far.

- The bears are still the strongest control as long as the currency pair is around and below the 1.1500 support level, and despite the technical indicators reaching towards strong oversold levels.

- The GBP/USD pair lacks the momentum that pushes investors to take advantage of the opportunity to buy aggressively.

Ready to trade our Forex forecast? Here’s a list of some of the best Forex trading platforms to check out.