Despite the recent hawkish signals from the European Central Bank and halting the pace of the record US dollar gains, the rebound gains for the EUR/USD currency pair did not exceed the 1.0113 level by the end of last week’s trading. This week’s trading may begin to stabilize around the 1.0045 level, as the euro is still facing the unknown about the future of energy in the Eurozone. The euro against the dollar reversed a short-lived rally last Thursday after European Central Bank President Christine Lagarde outlined the potential costs of addressing rising inflation, which led to the monetary union's biggest rate hike yet in a September decision.

The single European currency, the euro, briefly rose above parity early in the ECB press conference in September last week, but quickly reversed its gains after Lagarde said the ECB's resistance to inflation would have a greater impact on the European economy. It may lead to higher unemployment. "I would like to say this," Lagarde said. What I know today is that zero is not a neutral price and we are not the neutral price. And we're going in that direction but it takes a front-loading. It will take more hikes.”

The ECB statement and press conference made clear that the Governing Council would seek further rate hikes in order to curb economic demand by continuing to raise interest rates in the coming months as part of an effort to prevent businesses and households from expecting inflation to remain above the symmetric 2% target. This was after ECB staff cut GDP forecasts and significantly revised their inflation forecasts including 2024, the year at the end of the forecast horizon and the point at which consumer prices are still rising above the target of 2.3%.

Economic Outlook Bleak

While a European recession was not included in the ECB's September forecasts, it was also not ruled out and President Lagarde warned that the economic outlook would grow bleaker if the disruption to energy supplies necessitated widespread energy rationing.

“This downside scenario differs from the current situation in that it, in particular, includes a complete shutdown of all Russian gas supplies,” she added. We are almost there but there is still a bit of flow going through the Ukrainian scenario. But we also expect rationing across the whole eurozone and the lack of a measure of compensation between gas supplies and other alternative sources.”

All of this comes with higher energy and food prices driving inflation to 9.1% in August, driving up other prices across the economy as well and stoking concern among board members about the risks of a self-sustaining cycle of higher inflation. “We also have inflation spreading across the whole range of products particularly in the services sector where supply factors are less prevalent,” Lagarde added. So in the face of very high inflation, this is of scale and persistence across sectors of that for the sake of nature, and it is clear that resolute action must be taken.”

Thursday's increase in borrowing costs was the second for the ECB since 2011 and saw rates charged or paid on major refinancing operations, marginal lending facilities and deposit facilities rising to 1.25%, 1.5% and 0.75%, respectively. Derivatives markets have paused full pricing - in a larger move ahead of Thursday's decision, although it offered few clear advantages to the euro's price against the dollar.

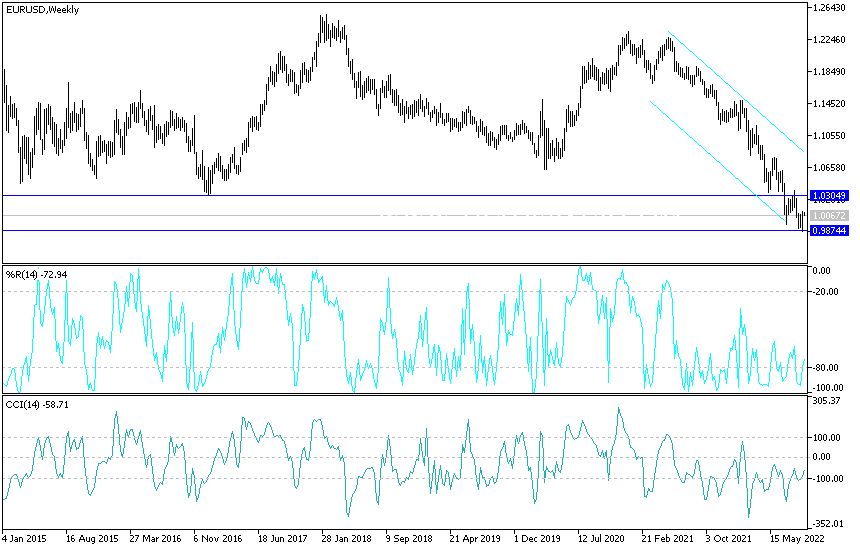

Technical analysis of the EUR/USD pair:

- It appears that the EUR/USD is trading within an ascending channel formation.

- This indicates a significant short-term bullish bias in market sentiment.

- The bulls will target extended gains at around 1.0073 or higher at 1.0120.

- On the other hand, the bears will target short-term profits at around 1.0006 or lower at 0.9957.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel, especially if it stabilizes below the parity price. This indicates a significant long-term bearish bias in market sentiment. Therefore, the bears will look to extend the current declines towards the support 0.9886 or below the support 0.9734. On the other hand, the bulls will target long-term profits at around the 1.0189 resistance or higher at the 1.0364 resistance.

Ready to trade our Forex prediction today? We’ve shortlisted the best Forex trading brokers in the industry for you.