Amid the continuation of the downward trend of the EUR/USD pair, it will react this week to the announcement of the updated monetary policy decisions of the European Central Bank. This happened amid expectations that it will force the bank to raise interest rates, as inflation figures in the euro area set records, led by Germany.

The strong rise in light of the faltering future of energy in the bloc, whether from the Russian-Ukrainian war, the rise in energy prices, and recently the historical drought that affected most of Europe. During last week's trading, the euro-dollar pair fell towards the 0.9900 support level, the lowest in 20 years, and closed the week's trading stable around the 0.9957 level.

European Central Bank policy makers, whose rate-raising cycle is just beginning, are preparing for the possibility of deflation in the eurozone as the prospect of a Russian gas shutdown threatens the economy. Such monetary fireworks are just the beginning of what is likely to be a defining month for global politics. Later in September, the US Federal Reserve will meet, with another rate hike by at least half a point the likely outcome.

According to the experts, the tone of discussions surrounding the ECB's next interest rate decision on September 8th appears to have changed. Several prominent members of the board of directors are pushing for significant rate hikes.

EUR/US:D Economic Analysis

The EUR/USD pair is trading affected by the reaction from the release of US data. The US Nonfarm Payrolls for August outperformed the expected 300,000 jobs by 315k. On the other hand, the country's unemployment rate rose to 3.7%, the highest level since April, missing the agreed forecast of 3.5%. The average hourly wage for the month grew by 5.2% from the same month last year, less than the forecast of 5.3 %. Elsewhere, US Factory Orders for July missed the (MoM) estimate by 0.2% with a -1% change.

From the EU, July PPI exceeded expectations (MoM) at 2.5% with a change of 4%. The year-over-year equivalent also beat expectations by 35.8% by 37.9%, while the German trade balance came in at 5.4 billion euros, beating expectations of 4.8 billion euros. Elsewhere, Germany's imports for July failed to meet the expected change of 0.8% with a -1.5% change, while exports beat expectations at -2.3% with a change of -2.1% (MoM).

EUR/USD Technical Analysis

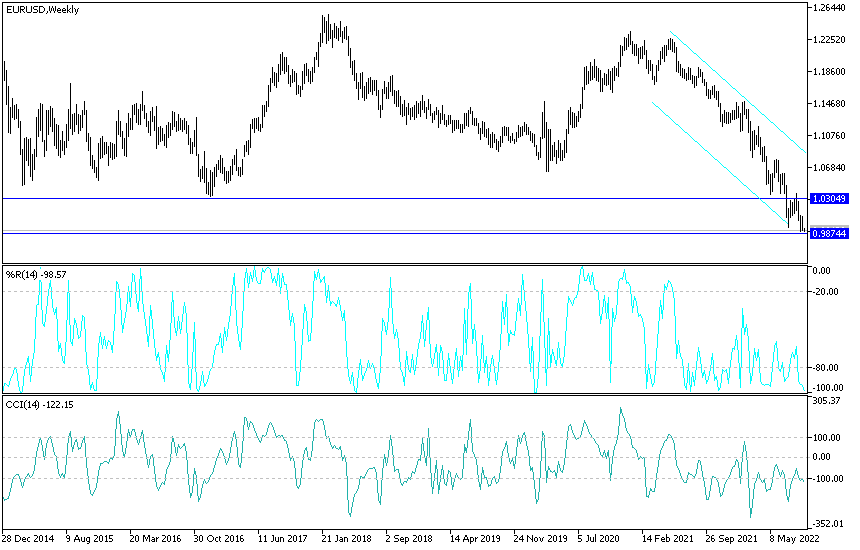

- In the near term and according to the hourly chart, it appears that the EUR/USD pair has recently completed a bearish breakout from forming an ascending channel.

- This indicates a sudden change in market sentiment from bullish to bearish.

- Therefore, the bears will look to extend the current decline towards 0.9941 or lower to 0.9900. On the other hand, the bulls will target potential recovery profits at around 0.9992 or higher at 1.0026.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a descending channel. This indicates a significant long-term bearish momentum in market sentiment. Therefore, the bears will target potential pullback profits at around 0.9810 or lower at 0.9612. On the other hand, the bulls will look to pounce on profits at around 1.0182 or higher at 1.0371.

Ready to trade our Forex technical analysis? Here are the best Forex brokers to choose from.